Value Stocks Risk/Reward

November 12, 2019

An issue I haven’t mentioned this year has been the profound weakness in Growth stocks since August. Most of the hot running high momentum stocks from earlier this year have been taken to the woodshed.

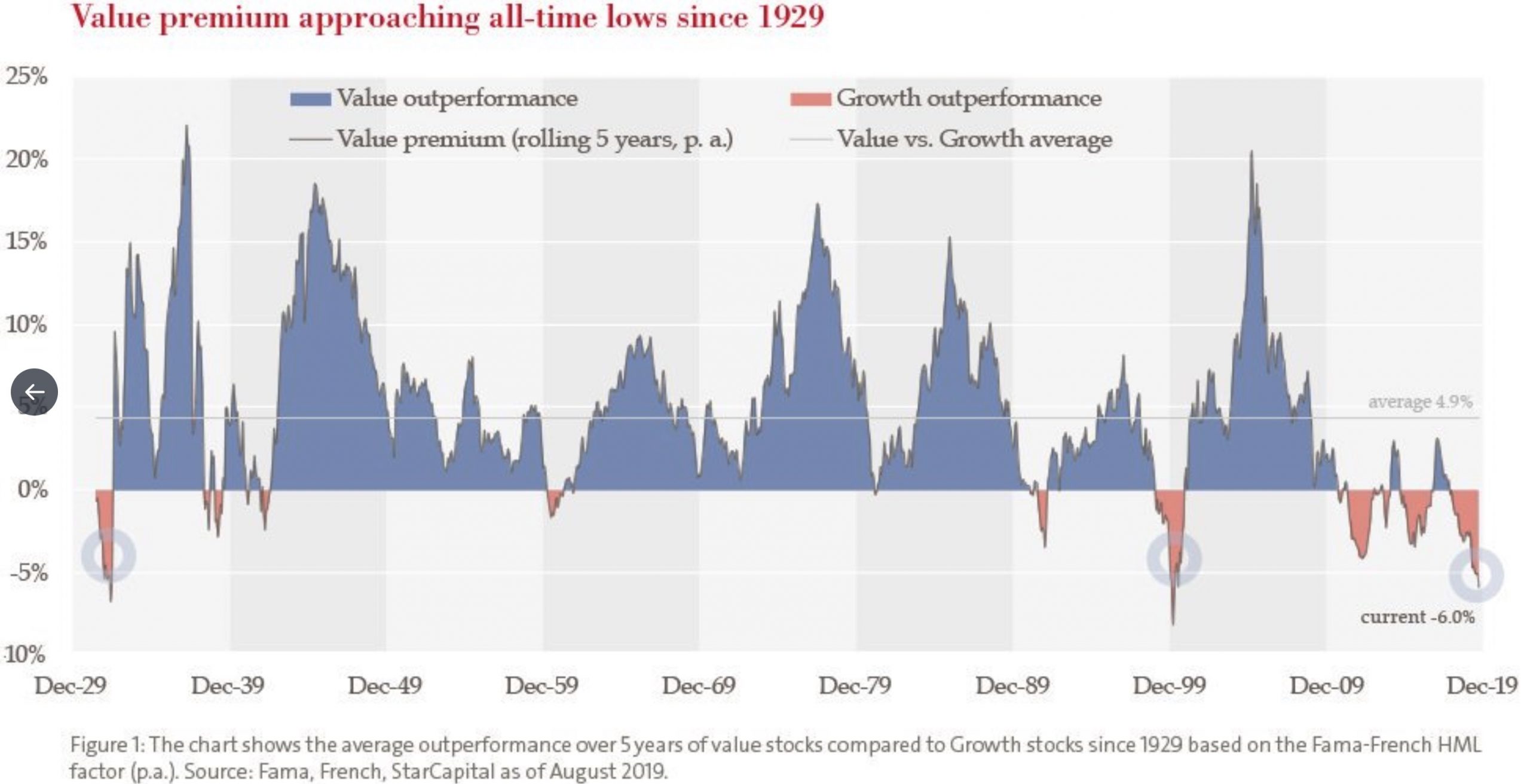

One of the reasons for money migrating out of high growth stocks is that the valuations became extreme relative to Value stocks. If there is once concept that investors in every asset class must understand is Mean Reversion. Prices always revert back to their long term trends. Think of the Tech Stock bust in 2000. The money from the sale of the overvalued Tech stocks went into Value stocks.

When I refer to “Value” stocks what I’m referring to are stocks that are cheap or have a low value relative to the underlying company. These are companies that are slow growth growing only single digits percentages a year. They can be boring businesses that don’t have a lot of sizzle to their story unless you’re a numbers geek like I am.

Right now the Risk/Reward is heavily skewed to Value stocks. The Value universe of stocks include a hefty percentage of banks and insurance companies. These financial companies saw their valuations compressed due to very low interest rates and the Inverted Yield Curve.

As you can see the Value stock methodology had dominated performance until the Great Recession of 2008. The lack of performance from Value does coincide with an uptick in activity or manipulation by the Federal Reserve.

What can’t be denied is that interest rates have moved higher which can increase profit margins and loan growth for banks and insurance companies.

Brad Pappas

November 12, 2019