The Pivot To Re-Opening

And Value

Quick Summary: The stock markets remain in a solid uptrend with no meaningful negatives aside from very high complacency. It seems to me that the passage of the election and the tremendous news from Pfizer has brought on a degree of elation that normally makes the markets struggle in the short term.

My proprietary models remain positive and are not close to reversing themselves. Plus, markets seasonality is in our favor December tends to be a strong month for stocks.

The month of November had two significant developments that were makes positive. The “Biden Bump” was especially strong partly due to the factor that we may get “a President Biden without the onerous taxes”. The tax issue won’t be finalized till the Georgia Senate elections in January. The Democrats need to gain both seats to control the Senate to pass a tax bill.

Investment-wise the tax hikes are market-negative but its unlikely the Senate election in January would cause the same degree of selling had the question been answered in November. Meaning: if the question was answered in November investors would likely anticipate a retroactive tax hike to January 1, 2021. Thus it would make sense to take gains in the window following the election to December 31, 2020.

The news that Pfizer had developed a vaccine with efficacy in adults over the age of 65 was 94% that was the biggest story of all market wise.

The news that Pfizer had developed an effective vaccine essentially creates a potential time line for the end of the recession. The Treasury bond market which was already in a downtrend (lower prices = higher yields) accelerated their decline with trading gaps to the downside. The downward price momentum on bonds might be accelerated should a new fiscal package be approved and what could be an explosive 2nd Q 2021 once the vaccine is distributed.

The Pivot to Re-Opening and Value

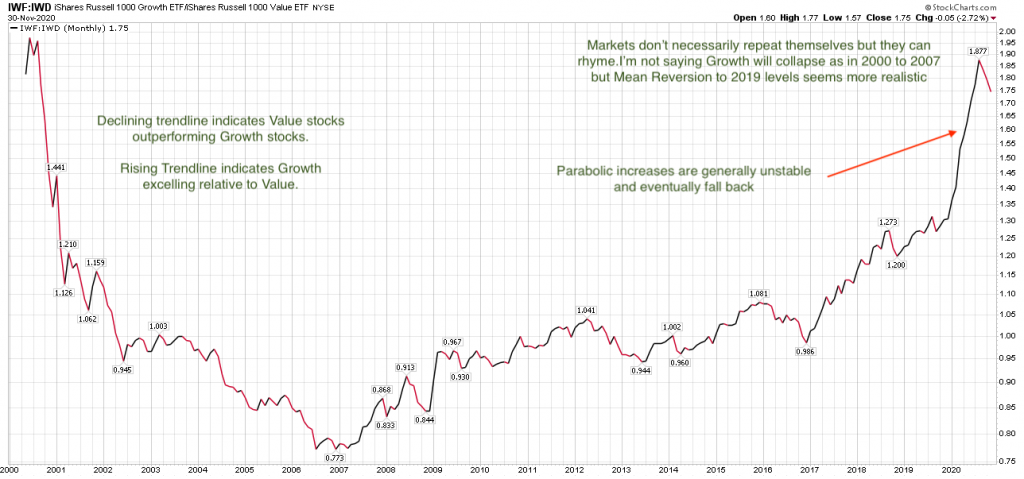

“Value” is a loosely defined term that means the shares a particular slow growth company are inexpensive relative to either a balance sheet, assets or earnings. “Growth” is the opposite with expensive valuations but they are high growth businesses. Growth has dominated for the past 10 years but the coming 12 months will be ideal for “Value” as the economy opens wide in the second half and interest rates rise. As the chart below shows the disparity between Growth and Value stocks is at a truly historic level. Some sort of Mean-Reversion should be expected.

For the past month or so trading Growth stocks seems like a zero-sum game. But Value and recovery stocks have been much steadier albeit slower, which is fine.

A rise in interest rates is beneficial to banks and many other financial stocks (which are Value stocks). This is not a prediction any more since it is already happening. Rising rates are indicative of an improving economy and job growth. Should a fiscal stimulus plan occur in the 1st Q of 2021 along with a potentially explosive economic rebound in the 2nd Q 21 the rise in interest rates could be much larger than anticipated. This is why owning banks is important now. The consensus is that interest rates are going to be “lower for longer”. That may be true for short term rates but inaccurate for long term rates.

The list of stocks that I considered my favorites for recovery in the late Spring and early Summer this year finally began to gain traction.

In addition to Banks and Financial stocks: Travel related stocks took off as well. Sabre and Expedia began a rise that confirmed my thesis that the hardest hit investments of Covid have a very favorable risk return longer term.

Our banks are PNC, Synovus and Comerica. All of our “Value” holdings are long term oriented. They may be sold from time to time but my perspective is to hold them until next year when the post Covid economy is obvious to all.

The post-Covid reopening stocks are being led (appreciation-wise) by travel companies Sabre, US Global Jets, Uber and Expedia.

In addition I added a starter position in Planet Fitness (PLNT) on 12/3. PLNT was an excellent Growth stock in years past and was obviously devastated by gym closings. PLNT appears to be in the initial stages of emerging from a long term bottoming process.

Howard Hughes Corp. (HHC) which is another Covid ravaged stock which we have a modest gain on is in corporate real estate. I call it the “anti-zoom” in reference to Zoom Video stock which was the darling stock of the Covid era. HHC is selling for just above Book Value which is $66.85 which includes $15 a share in cash. I’m not sure if it goes back to its February high of $130.

HHC’s largest shareholder is the shareholder activist Bill Ackman of Pershing Square. Ackman tried to lure Elon Musk and Tesla a few months ago to the HHC office space in Texas. It didn’t work but Ackman is very motivated to fill the empty space he acquired on the cheap.

Bitcoin

The narrative for Bitcoin is changing rapidly as it gains credibility within the 0% interest rate money market world. It is in the process of source of value for large corporations who see the limitations of Fiat based currencies. (Fiat currency is a currency backed by a government like the US dollar or the Swiss Franc)

Why? A paraphrased story goes somewhat like this: A very large international company, let’s say based in Switzerland is faced with a dilemma. The Swiss banks started to charge cash held in their accounts at a rate of .75% per year. Not only are they not paying interest but charging for holding cash in accounts.

Plus, the banks forbade the companies from withdrawing the funds in cash. You could do a bank to bank transfer but not in the form of actual currency. That didn’t sit right for anyone – other than the Swiss banks.

A partial solution emerges with Bitcoin and other Cryptocurrencies. Companies have begun to pull funds from banks and have begun storing cash in Bitcoin and other Crypto’s.

Companies like Square and Paypal have begun to accumulate Bitcoin for its long term transaction potential.

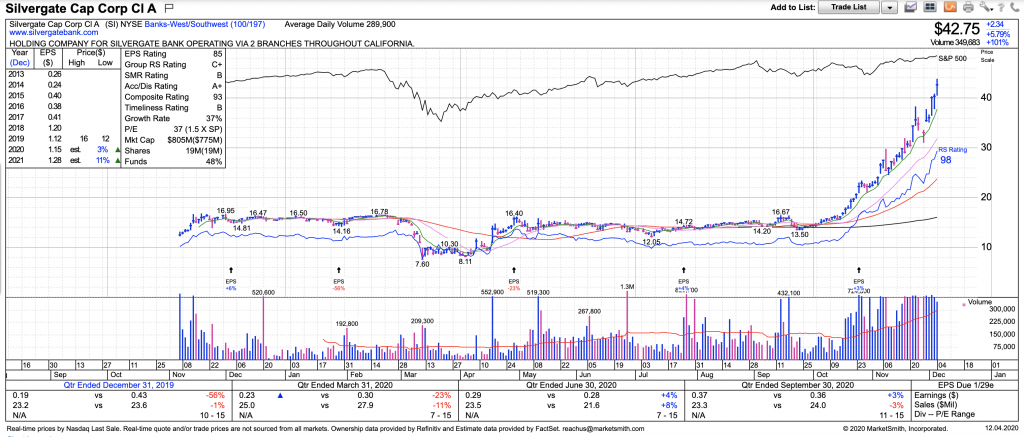

Silvergate Capital Corp. Symbol SI

SI is still relatively undiscovered by large investors and I doubt it will remain public or unknown for very long as its a very attractive takeover target. Because of Silvergate’s unique target markets and niche I could easily see a much larger traditional bank such has JP Morgain buying out SI.

Silvergate is the “go to bank for Cryptocurrency” banking and trading. They’ve created the Silvergate Exchange Network (SEN) which allows for 24/7/365 crypto trading in US dollars. No more weekend or holiday delays.

At Silvergate you can earn interest on your Bitcoin holdings up to 6% plus the Bitcoin assets can be stored in something like a deep freeze until you need to use it.

Our original entry price was $24 and I’ve accumulated more as the stock confirmed its strength. I have placed tight stop loss orders with preserving the gains in mind. Even still, this is a long term holding.

Natural Order Acquisition Corp. Symbol NOACU

NOACU is a new Initial Public Offering of what is commonly called a Blank Check company. Meaning there is no actual operating business at the moment but the company intends to buy or acquire business within its target market. In the case of NOACU the target market is Plant Based Food and meat alternatives.

We bought in right after the offering went public so this is a long term story. Eventually they’ll be buying and supporting plant based food companies. We’ll see how it goes.

Thats all folks.

Be Safe and Kind

Brad Pappas

December 3, 2020