RMHI Research Letter

Sept 17, 2024

The Dark Side of Long Term Investing and how to stay in the Light

Since 1996, RMHI has been an independent investment advisor. We have never been beholden to conflicts of interest from the mutual fund or ETF industry. We are able to think and research freely for the best possible solutions to investing and associated risk.

We are able to invest without packaged products that include an additional layer of fees to the fund company. This allows RMHI to invest client money with greater investment objectivity. In other words, we’re able to invest with successful investment strategies and protect the downside risk when applicable.

For almost 30 years I have been a Fiduciary to my clients with two primary objectives: to grow client capital within the boundaries of our Humane criteria and preserve that same capital. And, for most of my career in investment management I’ve been researching methods to reduce downside risk to investing in the stock market. Reducing risk becomes increasingly important as we get older and don’t have the time to recover losses like we used to.

The information below is absent from a large majority of clients in the Financial Planning, Mutual Fund – ETF industry. If you’ve read typical Mutual Fund / ETF sales literature you’ll no doubt come across bromides such as “Its time in the market not timing the market” “We’re investors for the long term” and my favorite “If you miss the ten best days/ years of the stock market your return will drop to __’”. (The fund companies never say how much your return would be if you MISSED the 10 worst days) None of these feel good mantras will ease your angst in a -30% to -50% bear market in stocks.

A -30% to -50% decline in the stock market takes years to recover. If the investor sold in panic (never smart to do) it will likely take even longer. The panic seller has to overcome both ego and fear before considering reinvesting. In this case it’s highly likely the markets will already have recovered before the panic investor thinks it’s “safe” to reinvest.

After the 2008 market collapse former manager of the Harvard Endowment, Mohamed El-Erian made the following statement: “Diversification alone is no longer sufficient to temper risk. In the past year, we saw virtually every asset class hammered. You need something more to manage risk well.” Without a doubt the best risk aversion strategy is to hold assets in cash/T-bills during a crisis.

The math of a large loss: If you lose -50% of your principal it will take a +100% return to break even. Even a loss of -30% takes a +44% return to break even. In both instances it takes years to get back to the high water level of your account.

Whereas if you took a modest year end loss of 10% it only takes an 11% gain to break even. Generally speaking when bear markets transition to bull markets it will only take months to regain your high water mark.

This type of research always reveals the conflicts of interest with the mutual fund and ETF industry. Every ETF and mutual fund company needs their investors to stay invested in their funds at all times, otherwise the fund can go out of business.

If investors were aware of effective risk reduction strategies (especially valuable for IRA’s) many funds and ETF’s would see significant selling and withdrawals. In my opinion, this is the primary reason that risk avoidance strategies are not presented to their investors.

For those that insist that long term market timing is impossible (I agree that short and even intermediate timing is impractical). I will be providing data and information from the following sources:

Gerald Appel of Systems and Forecasts

Mebane Faber. Spring 2007, The Journal of Wealth Management. “A Quantitative Approach to Tactical Asset Allocation”

Professor Jeremy Siegal’s: “Stocks for the Long Run” Sixth edition

Faber’s requirements for the system are basic and not optimized. (Optimization almost always leads to failure of the system.)

1. Simple, purely mechanical logic.

2. Price based only.

What are not included are opinions, emotions or any subjective analysis. I’ll be including charts in three primary time frames which are the same time period: 200 day simple moving average and 10-month moving average.

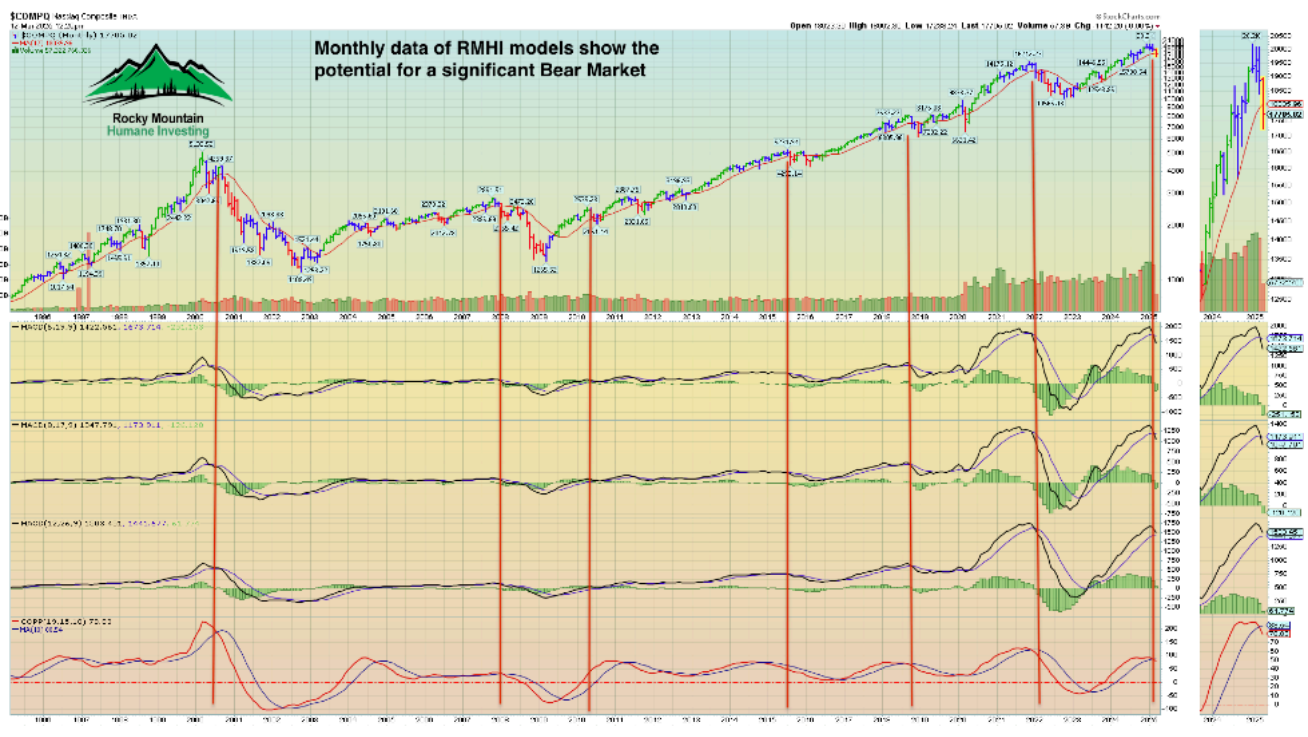

The chart of the model that Mebane Faber and Professor Siegal have researched and published is listed above. A very simple determination whether to own stocks or hold funds in cash. If the S&P 500 is above its 200-day moving average you should own equities. If below, the investor should be in cash or T-bills.

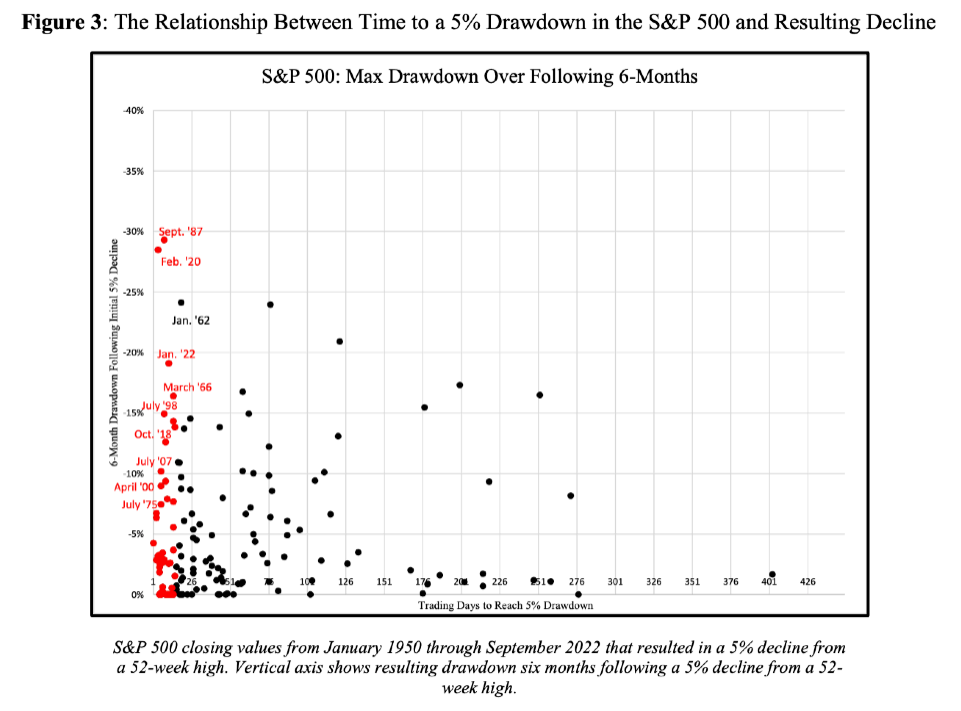

In Figure 5 we can see the maximum drawdowns for the stock market.

Figure 8b shows the reduced drawdowns if an investors used the Siegal/Faber system.

Positives:

This model will help you avoid most bear markets.

The more volatile the stock market generally the more effective the signals.

Cons:

While it keeps the investor out of stocks in the worst of bear markets it can cause false sell signals. Many of the false sell signals occur during low volatile market uptrends where the market sticks close to the 200 day average. To counter this Dr. Siegel suggested to only buy or sell if the market is greater or lower than 1% off the moving average. But in my research Dr. Siegel’s recommendation is not satisfactory.

In both Siegel’s and Faber’s research they use the 200 day moving average as a stand alone model. From my years of research and experience stand alone models need further confirmation from other indicators.

RMHI solution:

Pair the 200-day moving average with the Gerald Appel’s MACD model.

The MACD or Moving Average Convergence Divergence was developed in the 1973 by Gerald Appel of Systems and Forecasts. The MACD contains two moving averages: a short and longer term moving average. When the short crosses below the long, a Sell signal is generated. And, if the short moves above the long, a Buy signal is created.

When the MACD and 200 day moving average are paired many of the weaknesses of the 200-day moving average are eliminated.

Both models must concur with each other. If either model triggers a sell it must be confirmed by the other.

When our dual model system generates a Sell signal. Stocks should be sold and those assets should be invested in Treasury bills. Many other types of bonds and debt are usually heavily sold during recessions and bear markets.

The following charts below provide detail to the paired model Sell signals. Our dual model system confirms the market top in October 2000. The trend remained negative till the Spring of 2003. A

devastating peak to trough decline of approximately 50%. It’s interesting to note that the high of the S&P 500 in 2000 was 1553. The 2000 market top wasn’t reached again till 2007. It then fell to 666.79 at the bottom in 2009. The 1553 peak from 2000 was not surpassed until 2013.

They’re never a matter of “if” a big market decline will occur it’s just a matter of “when”.

The 2008 market crash is depicted below with confirmation of the S&P 500 knifing through the 200-day moving average and confirmed by the MACD in the lower portion of the graph. The sell signal occurred after the first leg of the decline.

In the chart above, the shallow market declines in 2010 and 2011 did not trigger Sell signals. The declines were not confirmed by the MACD in the bottom portion of the chart. Unconfirmed market declines have a tendency to be short in duration and depth.

Trend models such as ours only react after a change in trend has been identified. Meaning, they won’t get an investor out at the very top nor in at the very bottom.

One weakness to the MACD and our system is that during years of low volatility Sell signals have been modestly successful. In the chart above the 2018 signal followed several years of low volatility. The rising slope of the market rally from early 2016 was modest. This modest but consistent rally can be contrasted to the vigorous rally in 2020 and our present rally in 2024. This quality reinforces the concept that our paired RMHI system is of special value for the severe Bear markets.

Where do we stand today?

Two interesting points on this chart. The fall 2023 selloff went below the 200 day average and the MACD confirmed. But there are times when a bit of experienced judgement needs to be used. We were clearly coming off the 2022 market low and the slope of the 200-day moving average was positive.

As the end of August 2024 both indicators remain positive. The August dip to the 200 day or 10 month moving average was unconfirmed by the MACD and the 200-day moving average had a positive slope, so no signal.

While there was no signal there is evidence of slowing market momentum.

Summary: The financial advice industry’s standard boilerplate message is that investors should be invested (on offense) 100% of the time and that any form of market timing is ineffective. Clearly this presentation proves how wrong that logic is.

All market rallies have a definite lifespan and obviously there are times when there is a need to be defensive and cautious.

Investors should think in terms of offense and defense when it comes to long term investing rather than having continual risk exposure. Being fully invested at all times can be devastating in Bear markets.

As investors age closer to retirement the emphasis of defensive investing should be a higher priority. This is especially true when a Bear market can erase years of gains in short order and take an additional years to recover. For example, the 2007-2008 Bear market didn’t fully recover till 2013.

The primary goal of the system presented here is to reduce volatility and avoid significant market declines. However as anyone in my profession can attest there is never a guaranteed assurance that its reliability will continue in the future.

The system presented here has a secondary potential benefit of increased annual returns: Over the past 65 year the average rate of return on stocks has been 10.2% from 1957 to 2023. But in those 66 years there have been many severe market declines, which are factored in the average return. Could avoiding even 2 or 3 declines help performance? It’s possible but is based on the number and degree of severe market declines and the investors accuracy to reinvest determines the result.

Brad Pappas

September 2024

Disclaimer: The purpose of this letter is solely for the dissemination of information investment products or services. Investment advice or the rendering of investment advice for compensation will not be made absent of compliance with the state investment advisor requirements. For information concerning the compliance status or disciplinary history of advisor or firm the consumer should connate their state securities law administration.

The information contained in this letter and email should not be construed as a financial or investment advice for any subject matter. Rocky Mountain Humane Investing, Corp. expressly disclaims all liability in respect to actions taken based on or any of the information on this email.

As always, past performance is no guarantee of future success or returns. In fact future returns may be negative or unprofitable. Accounts managed by RMHI are not diversified. Meaning they own less companies than a diversified fund. Thus the portfolios may be more exposed to individual stock volatility than a diversified fund.