Essential Steps to Safeguard Your Assets in a Market Crash

Most investment firms will tell you to just “ride out the storm” when the market drops—but is that really the best approach?

In this video, Brad Pappas breaks down how bear markets can impact your long-term financial success and why proactive investors can take steps to mitigate risk before the downturn hits. If you’re nearing retirement or simply want to safeguard your investments, this is a must-watch.

Transcript:

Introduction to Rocky Mountain Humane Investing

Hello, I’m Brad Pappas, founder of Rocky Mountain Humane Investing, a fee-only investment advisor with clients throughout the United States.

The Reality of Bear Markets

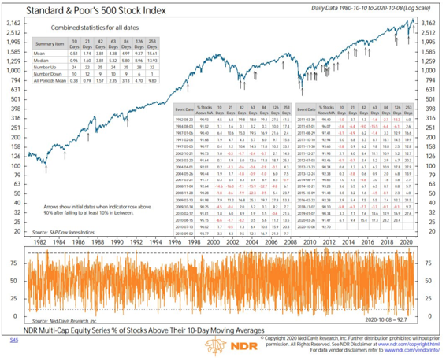

I want to address an issue that is paramount to individual investors today: how to cope and plan around a sudden bear market, where major indices fall by at least 20% or more. As an independent firm with client assets at Charles Schwab, we take a proactive approach to protecting client assets from extreme declines.

The Devastating Impact of Market Declines

Extreme declines can be disastrous for your retirement plan and future standard of living. How you handle these periods represents the single biggest challenge to your long-term financial success.

Misleading Advice from Large Investment Firms

If you are an investor with one of the large mutual fund complexes, you may be told that market timing is impossible and that you should stay invested for the long term. These statements are misleading. While short-term market timing is nearly impossible, longer-term strategic adjustments are achievable. Large firms managing billions of dollars have limited ability to raise cash or be defensive, meaning they often fail to adjust for high-risk markets.

The Importance of Investor Responsibility

For better or worse, it is the investor’s responsibility to protect their own assets. Many retail investors fall into the trap of recency bias—assuming that because their investments have performed well in recent years, they will continue to do so. This mindset is based on hope rather than reality.

A Real-World Example: The Impact of a Bear Market

Imagine you are a 55-year-old investor about to experience a 30% stock market decline with $500,000 at risk. Most bear markets take over a year to unfold, meaning you not only lose money but also time. After a year, your principal could drop to $350,000. To recover, you would need a 41% return just to break even. This typically requires at least two consecutive years of nearly 20% gains. By the time this recovery happens, you could be 58 years old, having spent three years with no financial progress.

The Flaws of the Buy-and-Hold Strategy

Many investors relying on a buy-and-hold strategy face this predicament as they approach retirement. Instead, proactive investment planning can help mitigate these risks.

A Better Approach to Protecting Your Assets

We implement a strategic plan that is not reactive but proactive, ensuring protection during bear markets without engaging in short-term trading. This approach provides several key benefits:

- Reduced Anxiety: You won’t need to constantly monitor financial news or check your portfolio balance.

- Lower Risk Exposure: During bear markets, we shift assets primarily into treasuries to preserve capital.

- Preparedness for the Next Bull Market: RMHI clients are positioned to capitalize on new market opportunities rather than recover from losses.

Important Considerations and Disclosures

As required by my compliance department, I must emphasize that there are no guarantees in investing. While we strive to protect client assets, no strategy can ensure absolute protection. Our approach is not designed to predict market tops or bottoms perfectly.

Schedule a Consultation

If you’re ready to discuss how we can help safeguard your investments, you can call me at 970-222-2592 or email me at brad@greeninvestment.com.