Below is a link to our August client letter.

Topics range from:

*Higher than normal cash levels in client accounts.

*In the midst of the three weakest months of the year – poor seasonality.

*Daily headline risk due to the President.

*Upward trend in US markets remains intact.

*Why we sell stocks that move up in parabolically.

August 2017 Partial Eclipse of the Markets

Stocks remain in an uptrend. For the first half of the year Tech stocks were the dominant sector. Since the Fed shift in June Healthcare and Finance have joined Tech in leadership. June witnessed a pullback in prices for the market leaders of which we owned many. This short pullback bottomed on the last day of June. Since June 30th most accounts are up at least 3%

No major economic risks at the moment for at least a year or two. While I expect some economic slowing in the second half of the year due to Fed rate hikes, slow growth doesn’t equate to Recession. The ingredients for a major business cycle top are still absent.

Last week I spoke with Bob Dieli of Nospinforecast.com regarding the present status of the economy within the larger business cycle. My concerns were due to the rate hikes and low unemployment and might these be signs of final “boom phase” of the economy. His answer surprised me:

Me: “If this was a baseball game what inning do you think we’re in regarding the economic expansion, the 7th or 8th?”

Bob: “I would say more like the 6th. The reason is that I don’t think the early stages of this expansion used up resources at the same pace as other long-lived episodes. We have yet to see any serious adjustment in interest rates, and we have yet to see even the slightest hint of wage pressures. Both of those are 7th and 8th inning types of events.”

“Of course, the one thing that you did not mention is the weather. A cloud burst, say in the form a failure to pass a debt ceiling bill, or some strange action by the FOMC with the balance sheet, or the Europeans getting their shorts in a knot yet again, could bring an end to the game before the 9th inning.”

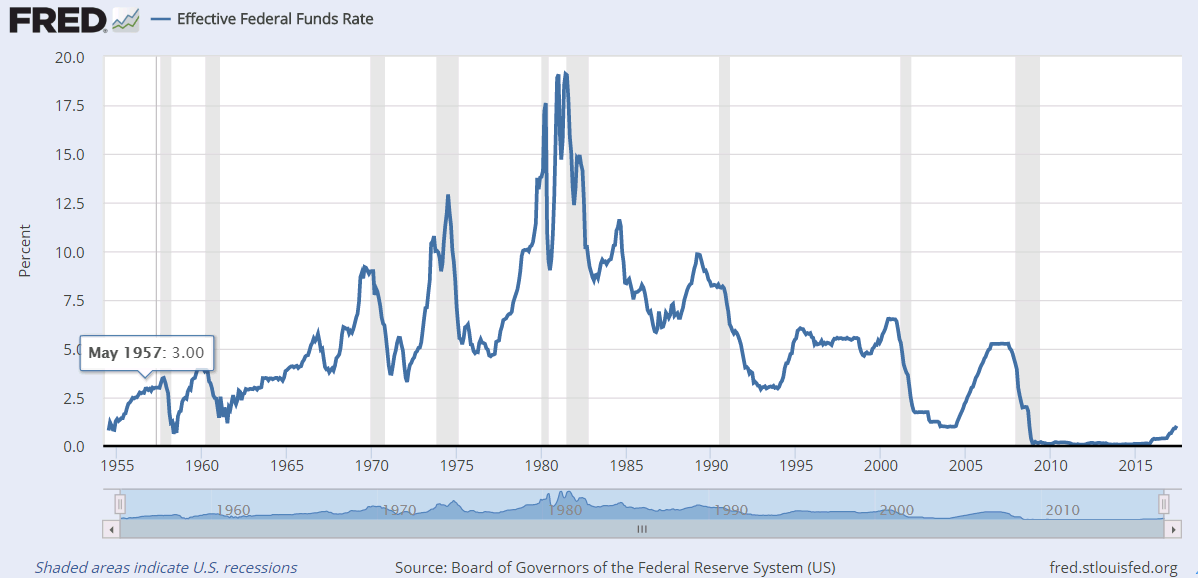

Interest Rates Rising: For 9 years the Federal Reserve has been pushing down long term interest rates by being heavy buyers of long term Treasury bonds. In May, based on the price trends in Treasury bonds I began to take some of our losing/lagging stocks and shift the proceeds to long term Treasuries. This was based on the price action trend and the potentially serious implication of the Yield Curve narrowing – see chart below. But, Janet Yellen at the Fed admitted she pays close attention to the Yield Curve too and announced the Fed will no longer be buying bonds but in fact selling bonds which put an end to the rally in Treasuries. This caused a sharp pullback in bond prices which triggered our sales which are always present to keep losses to a minimum.

So are at the end of a nine year cycle of continual downward pressure on interest rates? If you’re looking to lock in a rate on a mortgage this may be a good time to do so.

With the Fed selling bonds in the open market they will probably cause interest rates to gradually rise while reducing the money supply. (They sell the bond and the buyer gives them cash taking the cash out of the system) This does represent a potential headwind for stocks. However, central bankers will try to balance the sale of debt and interest rate hikes to keep growth and inflation neither too hot nor too cold. But eventually they’ll go too far and then we’ll have our next economic downturn. But according to Bob Dieli, don’t look for the downturn anytime soon.

Money, Markets and Murder

From the title you may think this months newsletter has more to do with Agatha Christie than markets will be disappointed. While I’m more of a Philip Kerr fan this letter will make reference to a case of repeating cycles and the serial murder of economic expansions.

The two biggest questions I receive revolve between “How can the keep rallying with the chaos and ineptitude in the White House?” and “How much longer till the next recession?”

The last letter I wrote analyzed the US stock market from a Technical view point in which I used various moving averages to identify major turning points in the market indices. The technical view of the markets is really the latter half of the “cause and effect” duo. Market reactions are the effect and in this letter I’d like to address the “cause”.

Markets and economies don’t roll over randomly. To quote the German economist Rudiger Dornbusch: “US economic expansions don’t die of old age. Every one of them was murdered by the Federal Reserve.”

Well now……….That may seem to be just colorful language but the continual coincidental circumstances of should dispel anyone thinking its just a mere coincidence.

The tightening of credit or raising short term interest rates is on the short list of weapons of choice for the Federal Reserve. Perhaps the evidence is strictly coincidental but we have a repeating circumstance that just so happens to be at the scene of every “murder”.

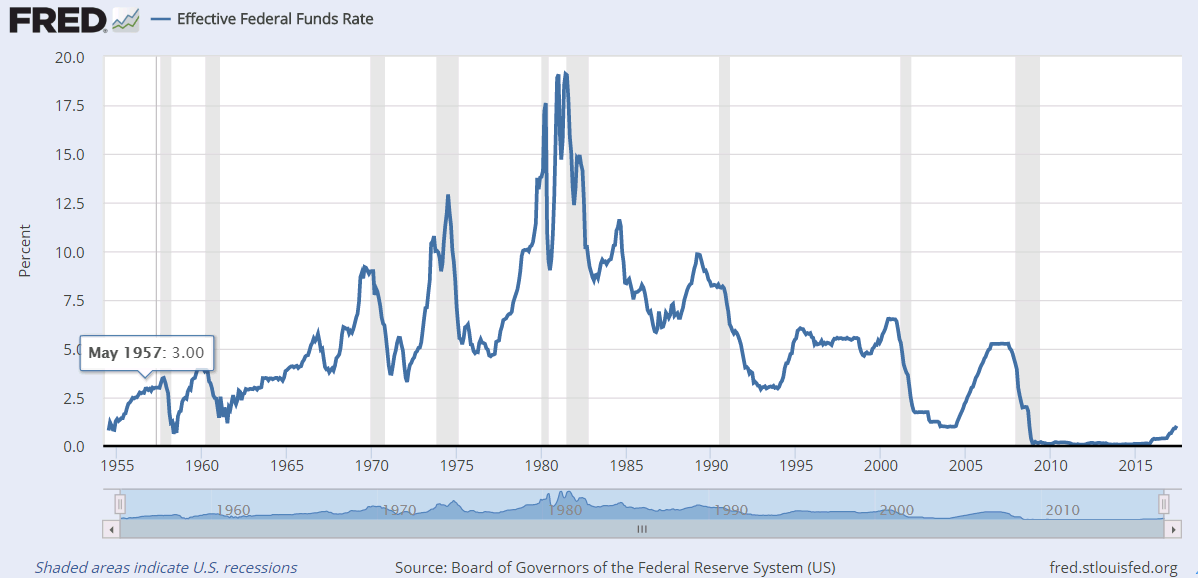

One does not have to be Hercule Poirot to see that a rising Fed Funds rate is seen before every major recession since 1954. Short term interest rates do not rise on their own accord. The Fed’s Open Market Committee pegs the rate in accordance with how they view employment and future growth. No magnifying glass is needed to see that sharp rises in short term interest rates are closely followed by economic slumps.

While investors have no control over short term interest rates investors do have control in the open market via supply and demand with long term interest rates. Normally long term interest rates are higher than short term rates. If a 30 year Treasury bond yields 4% and the one year Treasury bill is 1% we would say it has a positive spread and slope of 3%. The actual numbers change on a daily basis but the Trend is the most important factor to consider.

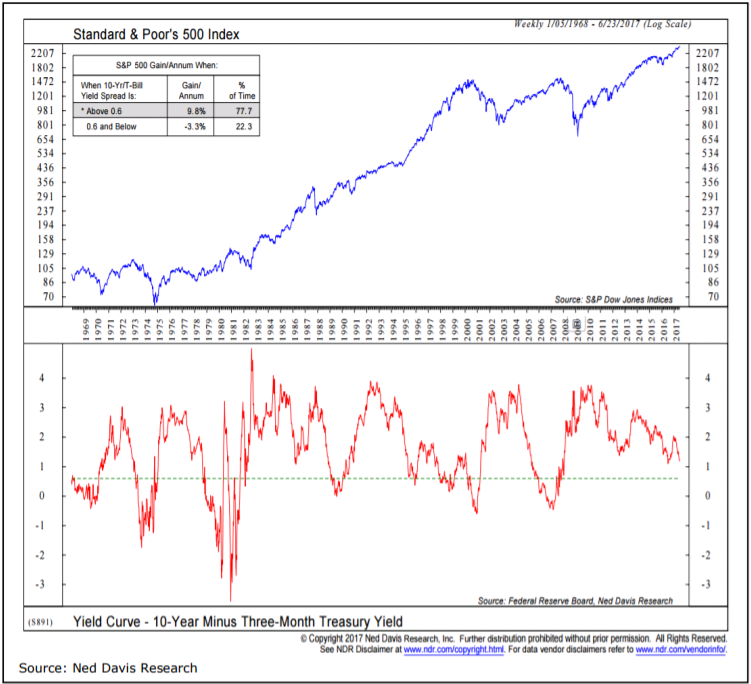

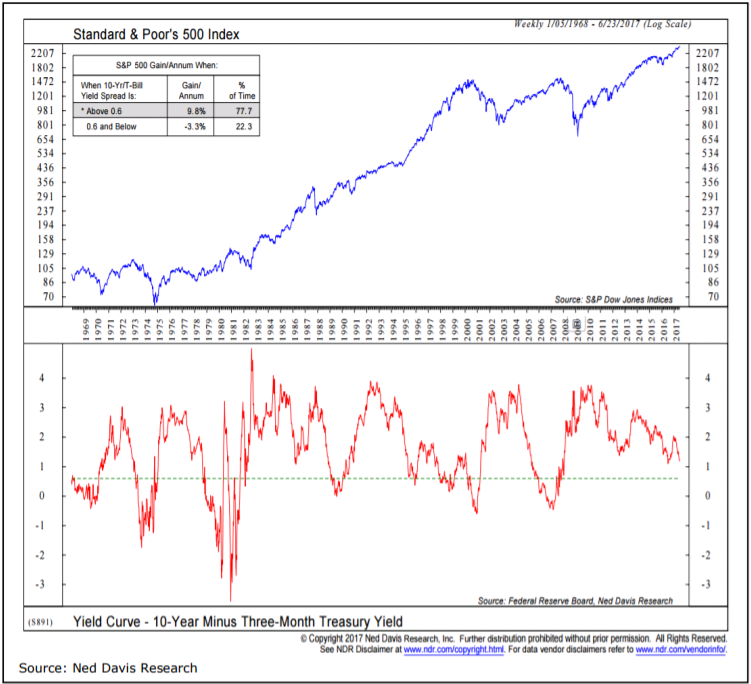

The chart below from Ned Davis shows the performance of US stocks based on the yield curve. They use a threshold of .6%. For example if a T-Bill rate is 1% the yield on the 10-year Treasury bond would have to be equal or below 1.6% to create a spread of .6%

According to the chart above when the spread is above .6% the gain per annum for stocks is 9.8% annually. Below .6% reveals a loss of -3.3% annualized. This doesn’t even take into effect the severe draw downs in account values or the increased volatility and risk, sleepless nights, higher blood pressure and visits to the Astrologer.

This is one of the biggest cons played on regular retail investors by mutual fund companies (especially Index funds and Robo’s) and financial professionals who tell investors that “markets can’t be timed” “you should buy and hold” or “you’re in this for the long haul” when they’re down 30%. This is because the fund companies get paid more to have you invested in their mutual funds rather than in cash or a money market account. I also know a several financial planners who’s “specialty” is reducing taxes on a portfolio. While that may sound good, at the same time their “buy and hold” philosophy means major losses in principal.

While it’s next to impossible to consistently “time” the market in the short term it’s very possible and wise to construct your investments in accordance with US monetary policy which is long term oriented.

I hope everyone has a great Summer.

Cheers,

Brad Pappas

970-222-2592 direct

720-310-8056 Skype

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. All expressions of opinion are subject to change without notice in reaction to shifting market, economic or political conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Past performance is no guarantee of future results.

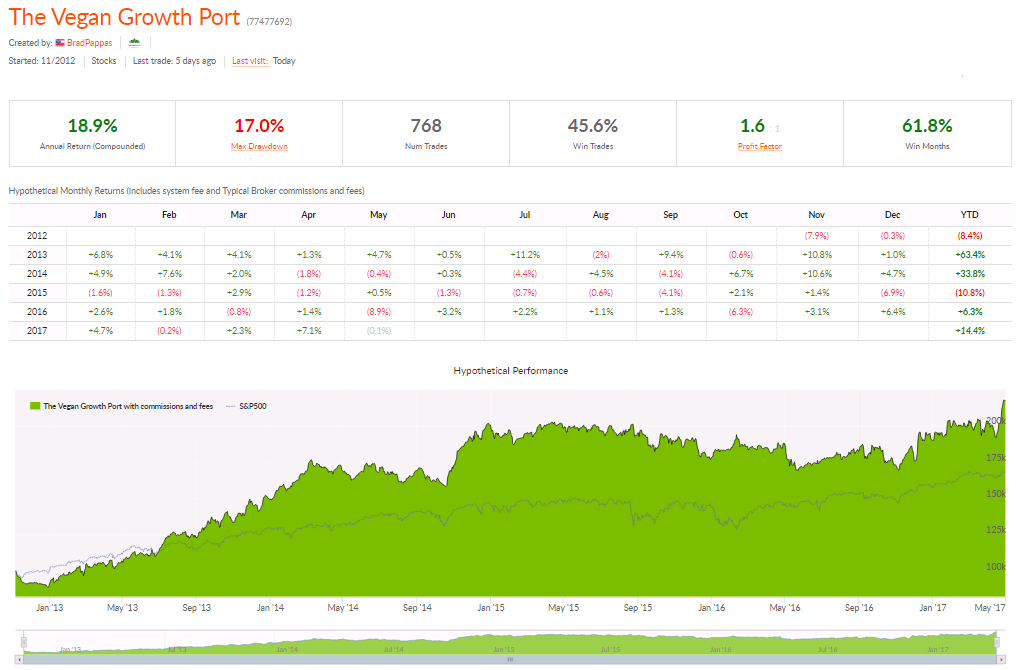

Years ago when we created the Model Data Access page on this website we only had back tested data to draw upon for our model portfolio. Now years later, we will have 5 years of live data come this November. Hence we will no longer update hypothetical back tested data and only focus on live data of our model portfolio (The Vegan Growth Portfolio) collected by third party Collective2.com

The changes to the Model Data Access page will happen soon. In the meantime we’ll post historical live data on our blog here.

During my career I’ve been interviewed several hundred times by potential clients. In almost every case during the interview the prospective client runs out of questions very quickly. Investors just don’t know what to ask. You can find many good questions with the aid of a Google search and every advisor will be able to answer them. But what about questions that could separate the good from the exceptional?

It would not be an exaggeration to state that skill and knowledge of your investment advisor can have a significant impact on your future. Ideally what you’re looking for is someone who can guide your assets smoothly in good times. Then, not be surprised and unprepared during the bad times. You’re not looking for perfection as it doesn’t exist.

Take most sales pitches with a grain of salt, the interviewee may sound convincing but how do you really know? You have to ask the right questions and below are a few that should help your process.

These questions are really designed to be directed to professionals who actually manage client assets such as RIA’s or portfolio managers. If you’re interviewing a Financial Planner they may not be able to answer one or more. FP’s are commonly generalists and defer client assets to products such as mutual funds, insurance or Exchange Traded Funds so they may not have the necessary expertise.

- “Are you a fee based advisor or do you work on commission?” Commission-based advisors or brokers may not follow your investments performance as compared to a fee-based advisor. In general, they’re salespeople who represent a brokerage firm. Fee-based advisors should work to protect your assets in down markets and grow them in good times, since their fees are based on total assets under management.

- “Of the assets you have under management are they mostly allocated to mutual funds, ETF’s (Exchange Traded Funds) or individual stocks or bonds?” If the advisor answers mutual funds, ETF’s or the basket approach used by FolioInvesting or any other Robo (Betterment) the odds are very high that the advisor is a generalist. Generalists are not prepared to get granular regarding your portfolio. Maybe you believe single digit long term returns are fine. But if you’re looking for long term returns in excess of 10% or more you’ll need an advisor with talent and expertise.Not every active portfolio manager will beat the major indices even though it’s really not that hard to do. Just don’t assume they all do well, most don’t. The good ones can answer the questions below and why wouldn’t you want a good one?

- Assuming you’re looking for an advisor familiar with Socially Responsible Investing: “Tell me your philosophy about socially screening a potential investment?” At some point the advisor should ask what your boundaries are or how pragmatic you can be. Be advised that the only way to be sure you have a diversified portfolio that is free of objectionable investments is via individual stocks and bonds. With individual securities you’ll have input.

- Once you’ve screened out the objectionable investments: “Please tell me how you select companies that pass the screen into a portfolio?” Or, “Do you have an investment style that you can tell me about?” Advisors who use individual stocks should have a proven method or algorithm to select their client investments. Without a systematic approach the returns will be more luck than skill and you’ll probably be better off with an Index fund. Beware of the advisor who tells you their system is extensively back-tested. Extensive back-testing leads to curve fitting or confirmation bias. These heavily tested systems will likely fail in the future. The best systems are relatively “loose” and have some discretionary room for the advisors experience and judgement.

- Ok, I’ll admit this next question is a “gotcha question” but every good advisor should be able to answer this one correctly: “Is the position size of a new position in portfolio based on a % of account assets or volatility?” Position weight should always be based on volatility. The most volatile investments should have the lowest % allocated to them. For more information on position sizing see Van Tharp.

- The classic: “Can you demonstrate a long term track record?” The SEC and state regulators frequently frown upon stating track records under the assumption that all returns by advisors are random. Managers and styles can run hot and cold but the best ones learn to adapt and evolve. If they can produce a track record ask if the use of margin or leverage was employed in the portfolio. Margin or leverage can increase the rate of return but it comes with exponentially rising risk.

- Every great investor or advisor has an insatiable curiosity and is a reader. We always want to improve which will be reflected in our client accounts. Ask “What is the last good book or white paper you’ve read regarding investing and what did you learn from it?”

- This is a simple question but it’s also the most revealing and the important on this list. Most advisors or financial planners fail their clients regarding long term risk. They fail their clients by either lack of knowledge or failure to understand risk. “How will you protect my assets during the next recession?” It’s been 9 years since the last major recession induced bear market. That means many advisors have never actually experienced a bear market with client assets under management. If the planner or advisor tells you that bear markets can’t be predicted or you get a disorganized word salad then reject the advisor. Learn to understand what an Inverted Yield Curve is. Otherwise be prepared to lose 35% or more of your portfolio some point down the road. Remember the law of numbers: If you lose 35% of your portfolio it will take a 50% return to break even again and that takes years.