The Post Parabolic Blues

4/8/2018

Since the 10% decline in the S&P 500 index in late January I’ve been using my Bull Market playbook to deal with a decline. Technically speaking we are still in a Bull Market but our Bull status is looking more precarious by the day. The Bull Market playbook means I’m looking for a double bottom or retest of the market lows off the initial sell-off. Secondly, I’d be looking to buy stocks on signs of a successful retest and rally.

Friday’s 2.19% decline was especially disheartening since it wiped out three days of gains. Stocks had been showing signs of recovery by trying to build a base from which to rally. Previously, markets were appeased by the story that the White House was using the tariff threats as a negotiating tool. But Friday’s news showed that markets are not buying that story any more. This is a dangerous and unpredictable situation that leaves any investor unhedged in stocks vulnerable to policy mistakes and reckless statements from the White House or cabinet.

The second leg down rallies have been relatively weak with reduced volume while declines have been larger in magnitude and increased volume (not good). This reveals that large institutional investors are in a liquidation mode and are using rallies to sell rather than using declines to accumulate. This is Bear Market behavior and is giving me pause to reassess the likelihood of another another significant leg down for stocks and the possibility of a Bear Market.

Perhaps this weakness is the aftermath of the parabolic rise in stocks earlier this year? Plus the extreme readings of investor sentiment? It’s possible, but I’d argue that stocks and bonds are now reacting accordingly to an aggressive Federal Reserve and a much higher than average possibility of policy mistakes from the White House.

Chart 1

Chart 1 above, courtesy of Carl Swenlin of Decisionpoint, shows the importance of the $257 level for the “SPY” aka S&P 500 ETF. Both the 200 day moving average and the underlying trend line from the 2016 rally converge at nearly the same level.

There are also other important issues the world stock markets are contending with:

The global economic recovery is mature and slowing. Worldwide GDP data is showing clear signs of slowing.

Policy Errors: The tax cuts are the personification of fiscal irresponsibility and there’s no going back.

Trade Wars are “good and easy to win”. Investors aren’t fooled in the least by this rhetoric (see Smoot-Hawley Tariff Act). We’ve never had a President who can just as easily talk up a stock market and talk it down with rhetoric within weeks. This is certainly a market headwind for stocks.

Chart 2

Aggressive Federal Reserve: The “Yield Curve” (shown above in Chart 2) is growing increasingly negative as short term interest rates are rising which will eventually kill the economic expansion. This causes investors to buy long term Treasury bonds. The higher short term yields and lower long term yield flatten the difference between short and long term rates which reduces the incentive for banks to lend.

The Yield Curve is a simple indicator and one of the most powerful tools to predict markets and the economy. Once the curve drops to .5 its “Goodnight Irene” for stocks and “Good Day Sunshine” for Treasury bonds. This is why we’ve recently added long term Treasury bonds to client portfolios.

If you’d like to learn more about the Yield Curve, there is an array of data from none other than the Federal Reserve:

https://www.clevelandfed.org/our-research/indicators-and-data/yield-curve- and-gdp-growth.aspx

Our Present Status: A sharp break in the price in Chart 1 below $257 without a rebound implies there is more selling ahead, which could be significant. Since my style of investing is based on reacting rather than predicting, I’d look for a $257 break to increase our existing hedges and further reduce stock holdings.

Should the price break below $257 not occur or occur briefly, I’d keep the status quo but expect the bottoming process to take longer than expected. I’d likely prefer to reduce stock holdings in strength until we see a positive change in market behavior.

Treasury bonds: My W.A.G. for Treasury Bonds and the economy is that the Yield Curve inverts in 2019 which will cause a full blown bear market in stocks and bull market in Treasury bonds. T-bonds could rally by more than 20% due to the reduced effect of lowering interest rates in an already low rate environment by the Fed. This could be followed by recession and bear market low by 2020.

Bottom Line: I’m agnostic to market direction as we can generate profits in accounts regardless of market trends. It’s the transition periods which we are possibly in that are tricky to assess. Once a new trend emerges, be it up or down, I’ll adapt and do my best to continue generating profits on your behalf.

Thank you,

Brad Pappas

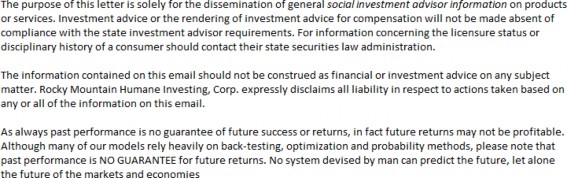

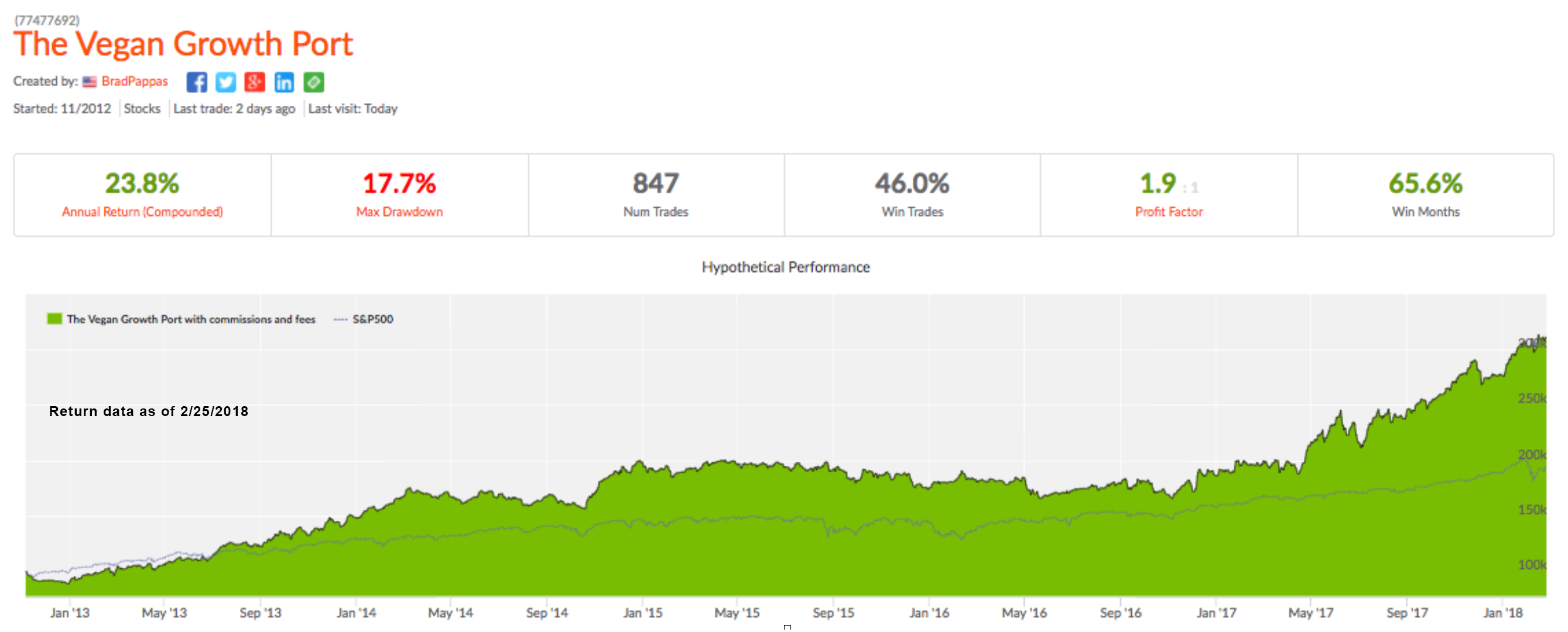

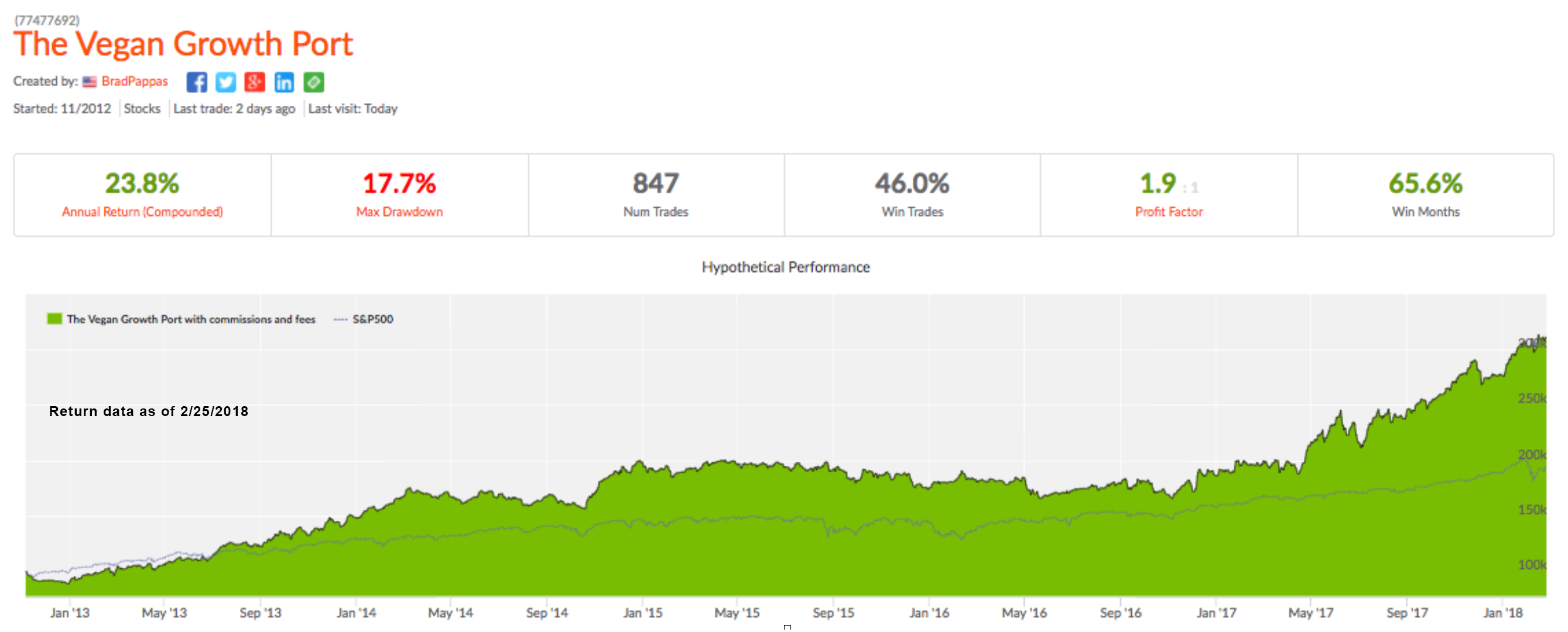

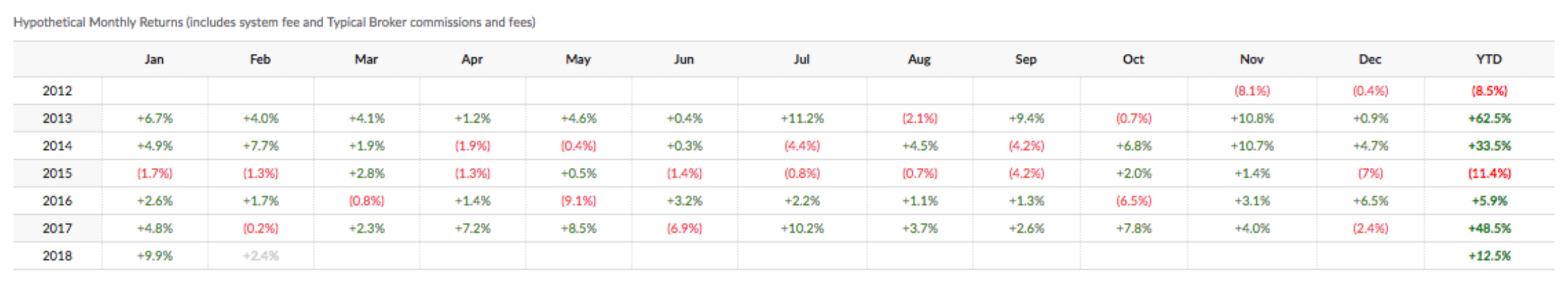

We’ve updated our Vegan Growth Portfolio model results with the data through March 30. So far, VGP is well ahead of the S&P 500.

Access our VGP Model Data

It has certainly been a wild three weeks after a peak to trough -11.8% decline in the S&P 500.

As we’ve been saying in our blog https://www.greeninvestment.com/blog/, during January we were trying to factor in the effect of emerging strength in the VXX along with rising interest rates due to a weak bond market. If you add to this a parabolic move in US equities, I felt that stocks could sell off sharply, which they did.

For our clients (which is reflected in our collective2.com model portfolio), we sold off approximately 40% of our equity holdings and added a 10% “hedge” by buying the emerging VXX to offset potential stock market losses should the decline occur. The downside to adding a suitable hedge to a portfolio is: should the market continue to rise any gains would be relatively muted or non-existent. I consider that a small price to pay to reduce potential risk and volatility.

To quote super investor Paul Tudor Jones: “The most important rule of trading is to play great defense, not offense.”

Client portfolios held their value and the Vegan Growth Portfolio model shows a positive gain for the year of 12.5% (net of all fees and expenses) versus 1.5% for the S&P 500.

A good advisor or investment manager should be paying attention to the many moving parts that could affect their client portfolios. In this instance, we were able to successfully anticipate the sell-off. That won’t always be the case and sometimes we’ll be wrong as well. I think it’s critically important for the long term success of our clients to act when we think the odds are good that we’re entering a high risk period.

Cheers,

Brad Pappas

President, RMHI

Brad@greeninvestment.com

970-222-2592

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. All expressions of opinion are subject to change without notice in reaction to shifting market, economic or political conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Past performance is no guarantee of future results.

Enjoy The Ride!

10/19/2017

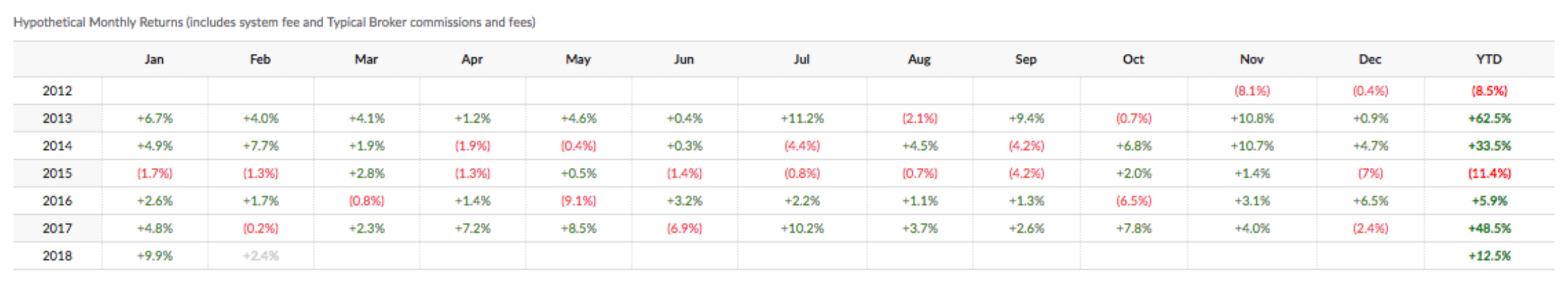

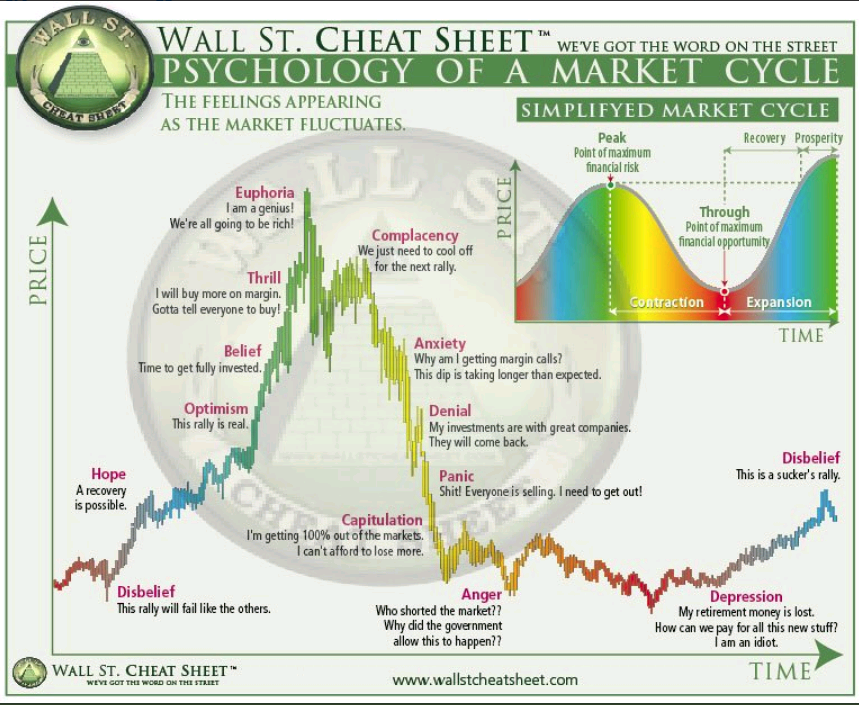

Since the market bottom last November the S&P 500 has rallied from 2083 to 2560, a very healthy gain of 22.8% not including dividends. Despite these gains there are almost no signs of euphoria within the investing community which leads me to think this rally still has a long way to go. Euphoria is a necessary evil that’s almost always seen at major market highs when investors refuse to believe the market will roll over.

Is there a valid case to be Bearish? Yes, but market momentum always takes precedence. Eventually the bears will be right but it may take a few more years and in the meantime so much opportunity will be lost. The bearish arguments have been around for years and completely dismissed as markets make new The bear case always sounds intelligent and well thought out but their losses and opportunities missed can be staggering.

This week marks the 17th time in the past 90 years that stocks made new all-time highs each day of the week. In only ONE instance did this ever mark the exact top of the stock market (1968). Higher highs occurred 94% of the time.

Once a trend has been established it tends to persist and run its full course.

Investing always has some form of anxiety for investors to contend with. If it’s not nervousness with the decline in your account value it’s the fear of the value rising too much and worrying you’ll give it all back. Is there a Goldilocks too hot – too cold – just right equivalence? Nope, but keep things simple as in try to sensibly grow your principal as much as possible in the good years and lose as little as possible in the bad. And, try not to mess it up in the meantime which is why: Temperament can more important than intellect.

In past years bonds offered a decent yield which allowed an investor to gain some income and diversify from stocks. The problem in this era is that yields are very low and in order to gain a modest, even a high single digit return there must be some increase in bond prices and very little of that is happening now.

One of the best books ever written on investing was authored by Jesse Livermore “How to trade in stocks” published in 1940. At his peak Livermore was worth an estimated $100 million in 1929 dollars after starting from scratch. His approach was systematic and still effective today and I use many of the rules he originally created for himself.

One of Livermore’s lessons was: “Money is made by SITTING not trading” To paraphrase, when you know you’re in the right you stay invested until the rally fades. You should remain in the stocks that are trending higher and take small losses along the way (never ride a losing stock down hoping it will turn).

The majority of “easy” money made in stocks is made during two unique phases of the economy/markets: The violent rally higher during the transition from recession to expansion and during long trending rallies in the mid cycle of the expansion like we’re experiencing right now. Smooth trending markets may happen just once or twice in a decade so it’s important to maximize the opportunity when it’s present.

While it’s part of our management philosophy to protect our clients during major down drafts, we do not sell prematurely or pretend that we can call a market top. “Top Calling” the stock market is a way of gaining media exposure and attention. Top Calling has nothing to do with solid investment management since astute advisors know it can’t be done. The better option is to let the market take us out when the time is right with our built in exposure systems.

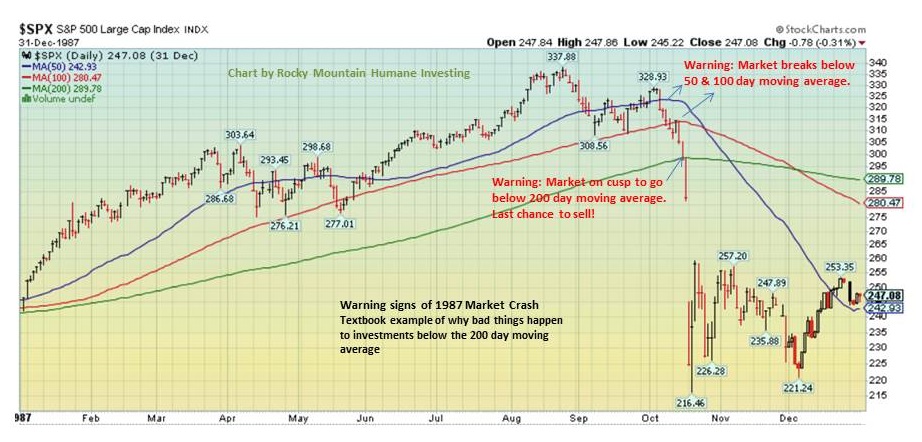

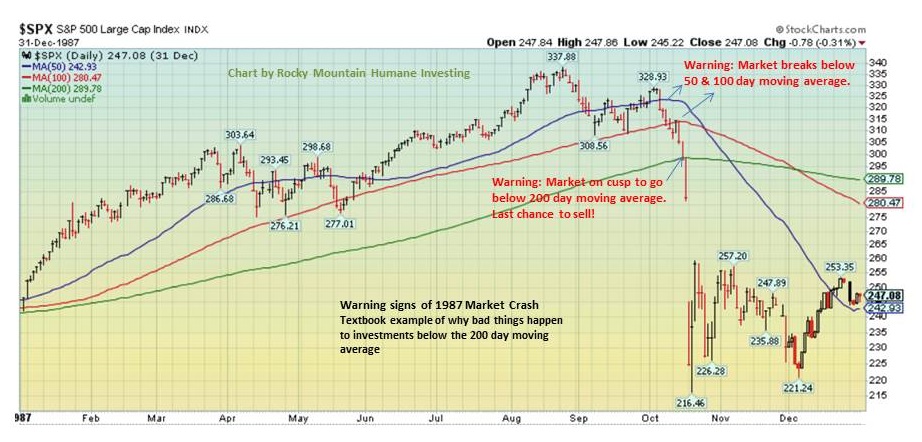

Charting the warning signs of the 1987 crash

It’s been 30 years since the 1987 crash so why not look at it closely for lessons?

The evolution of market tops is a gradual process whereby markets weaken as selling and distribution increase. Sometimes the flat sideways trend is nothing more than the “pause that refreshes” before another up-leg commences. However, sideways/choppy trends can also be the early stage of something more ominous.

In the summer of ‘87, the bond market was very weak with declining prices and higher yields which were becoming increasingly more attractive to stocks. This was causing a migration from stocks which began to manifest itself in August. These were the grand old days when investors wouldn’t buy a municipal bond unless it had a tax free yield of 10% or more.

Stocks peaked in August then sold off by 8% in September then rallied 6% into October before crashing. The decline in early October breached the 50-100-200 day moving averages which would have triggered a wave of sell signals for us. We always use the 200 day moving average as the ultimate cut off for owning stocks. I consider declines below the 200 day to be Bear Market country.

Summary: Enjoy the ride.

Brad Pappas

970-222-2592

Brad@greeninvestment.com

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. All expressions of opinion are subject to change without notice in reaction to shifting market, economic or political conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Past performance is no guarantee of future results.