Vegan Growth Portfolio Model results updated through March 1, 2021

We’ve updated our Vegan Growth Portfolio model results with the data through March 1, 2021.

We’ve updated our Vegan Growth Portfolio model results with the data through March 1, 2021.

We’ve updated our Vegan Growth Portfolio model results with the data through Jan 30, 2021.

Bring On The Sell-off!

1/30/2021

Quick Summary: Two weeks ago I began raising cash in accounts because investor sentiment was too hot and market breadth was eroding. Too many traders playing with borrowed money “margin”. It appears we’re seeing forced liquidations as we’re down another 600 pts. We don’t need a formal Sell signal to occur when our Stop-Loss orders get triggered en masse. The combination of too much speculative trading in margin combined with future market scrutiny by regulators may be causing institutional investors exit by the side door.

We presently have just two stellar holdings: Sivergate Financial and Innovative Industrial Properties. In both cases we have such a large profit cushion and they continue to show relative strength in weak market that taking a profit here may not be the wisest of choices.

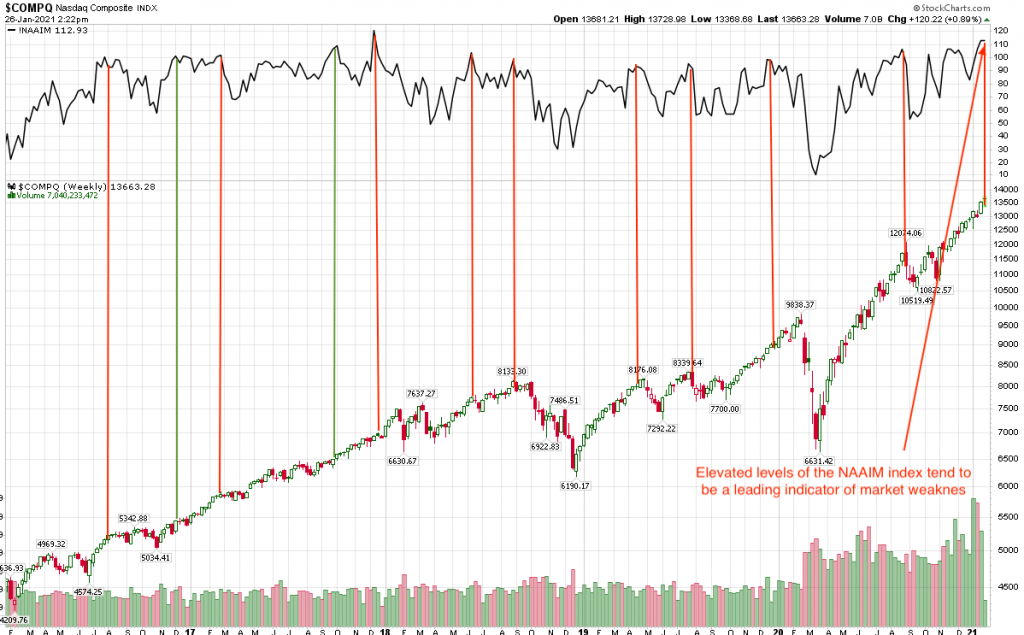

The NAAIM Index (naaim.org) publishes a survey of active managers like RMHI to find out their current market exposure. Last week’s reading of 112.93 is rarely seen and means that not only are active managers over 100% invested but they’re adding leverage/margin. As the chart shows these kinds of readings are common near intermediate term market peaks.

For more than a month I’ve been watching the grotesque level of mindless speculation that has exploded with Gamestop or GME. The media has created an image of the small time investor having revenge upon the evil billionaire hedge fund managers, akin to David vs. Goliath. Nothing could be farther from the truth.

The business of Gamestop has not changed. They have an eroding business model where gamers no longer need to go to a store to buy games since they can download them from home or where ever.

Short selling is not new and serves a valuable service since short sellers seek out and punish fraudulent companies.see Enron, Worldcom, Conseco, Baldwin United, etc. This provides a checks and balances alternative to the always bullish media market hype.. In addition, most stock market rallies begin when short sellers start to buy stock back to lock in profits which creates the initial market bounce.

What is new is the interest rate policy of the Federal Reserve manipulating interest rates to near 0%. Near zero interest rates crushes savers who used to rely on CD’s and other interest bearing instruments. These investors are then forced into risk assets such as stocks.

Near 0% rates coupled with substantial stimulus money, bored people, time and smart phones on hand have created a toxic mix of speculation. Trading in GME is a textbook Greater Fool Theory. The fool who pays $337 for GME shares needs an even bigger nitwit to sell to at a profit.

Short sellers who were short the shares of GME are then forced to buy GME shares to cut their losses. Thus creating a whirlwind of self fulfilling behavior.

I’m fairly sure that at the root of this is not the little guy small investor but other big players, They’ve created a modern day Ponzi Scheme. Big players who made early bets on GME back in September when it was trading under $10 are the real beneficiaries.

The tactic of using Social Media to channel investor behavior is new and probably here to stay. Just this morning Elon Musk tweeted that he like Bitcoin which sent our shares of Silvergate to a new high of $102.

It’s laughable to me that the politicians and regulators who were asleep now want “investigate” and show concern for the very environment they created.

But all of this kind of behavior is really nothing new. As Jesse Livermore said over 100 years ago: There is never anything new in the stock market. Human behavior never changes. It always shifts from fear to greed and back to fear again.

However, the levels of speculation we’re witnessing are associated with market peaks. Less reputable brokers like Robinhood run a real risk of becoming insolvent due to the probability of unsecured debits in client accounts. In other words traders who are borrowing money to buy GME can not just lose the equity in their accounts but have the value go into the negative.

Or, as I witnessed last night Robinhood forced traders out of their holdings without their knowledge or consent at the the low price of the day? Guaranteeing losses? Bring on the lawyers and class action suits.

In my experience this period of market history is fascinating and eventually probably will lead to tremendous losses. Investors of all kinds tend to act in a herd mentality and when the herd decides to start selling, my guess is the market could easily decline by 20% or more.

If we’re lucky.

I hope we do decline. We are prepared for it with an extremely high amount of cash on hand. Smaller accounts are 100% cash.

I would love nothing more that be presented with a new Bull Market cycle that would reveal itself after a severe market decline.

Risk Control

I’d like to spend some time on how RMHI emphasizes risk control and the methods used. Clients never see this data. If you access your account at Schwab or from your account statements you won’t be able to find it. I spend most of my days monitoring a dashboard of potential open trades that are stop loss orders.

A Stop Loss order is an order that I have placed at Schwab on your behalf to protect your principal. At the time of purchase I’ll add a Stop Loss Order set between 4% to 5% below cost. This is all I’m willing to lose and it means that losses will be small. But it also means that trading is going to be more frequent. There’s no perfect formula but I find that 4% is very effective despite more activity.

When we buy a stock and it declines from the initial prices to a loss between 4% or 5% the shares will automatically be sold. It’s not a guarantee that the sale price will be exactly at 4% since the next trade price could be lower.

Should the stock price rise the Stop Loss order rises accordingly. If the shares rise 7% or more the Stop Loss Order is adjusted to the cost of the shares. A winning trade should never be allowed to be a loser.

One way I wanted to improve performance was to find ways to increase our Profit to Loss ratio. A 2-1 ratio means we’re averaging a gain of $2 for every $1 we lose. A P/L ratio of 2-1 is good but ours had fallen from that level to 1.6 to 1 which is unacceptable.

To improve the P/L ratio it means a complete reevaluation of how stocks are selected and an effective formula for how they are sold. Its been my observation that the good trades work almost immediately, usually within a day or two since the purchase. Once the trade proves itself I’ll add on more shares which is called “pyramiding”.

But in a favorable market a 4% stop loss is very effective and if the order is “stopped out” meaning it was executed, we just move on to another stock with favorable behavior.

Cutting losses short also means we don’t dwell on them for weeks which could cause us to miss out on other potential winners.

The key is to identify which stocks could be the significant winners and to let them run for as long as they can. Stocks like Silvergate are rare and in most cases its best to sell a stock if it reaches a gain in the 20% range.

But even if a stock only rises by 10% when the gain is taken its still a 2-1 win loss ratio if a 5% stop loss is used.

Last week I decided to calculate what our Profit/Loss ratio has been since I made the changes. I used the model account I have to collective2.com. Its the fairest way to measure since it copies our own trading in an objective way.

Since November and up to this week our Profit and Loss ratio had improved to 5-1, which made me very happy.

However, the P/L ratio of 5-1 does NOT include our existing holdings, only those shares that were sold. Since the sale of 1/3 of our Silvergate shares this week our cost basis rose from approximately $28 to $35. Meaning the gain from $35 to the present price of $94 has not been taken into account. The same holds true for Innovative Properties.

The bottom line for the use of Stop Loss orders and in coordination with proprietary market buy and sell signals is to smooth out the growth of equity in client accounts.

We will not always be invested but fully invested only when the odds are in our favor.

Be Well. Be Kind.

Brad Pappas

January 21, 2021

Long all stocks mentioned.

Quick Summary: The stock markets remain in a solid uptrend with no meaningful negatives aside from very high complacency. It seems to me that the passage of the election and the tremendous news from Pfizer has brought on a degree of elation that normally makes the markets struggle in the short term.

My proprietary models remain positive and are not close to reversing themselves. Plus, markets seasonality is in our favor December tends to be a strong month for stocks.

The month of November had two significant developments that were makes positive. The “Biden Bump” was especially strong partly due to the factor that we may get “a President Biden without the onerous taxes”. The tax issue won’t be finalized till the Georgia Senate elections in January. The Democrats need to gain both seats to control the Senate to pass a tax bill.

Investment-wise the tax hikes are market-negative but its unlikely the Senate election in January would cause the same degree of selling had the question been answered in November. Meaning: if the question was answered in November investors would likely anticipate a retroactive tax hike to January 1, 2021. Thus it would make sense to take gains in the window following the election to December 31, 2020.

The news that Pfizer had developed a vaccine with efficacy in adults over the age of 65 was 94% that was the biggest story of all market wise.

The news that Pfizer had developed an effective vaccine essentially creates a potential time line for the end of the recession. The Treasury bond market which was already in a downtrend (lower prices = higher yields) accelerated their decline with trading gaps to the downside. The downward price momentum on bonds might be accelerated should a new fiscal package be approved and what could be an explosive 2nd Q 2021 once the vaccine is distributed.

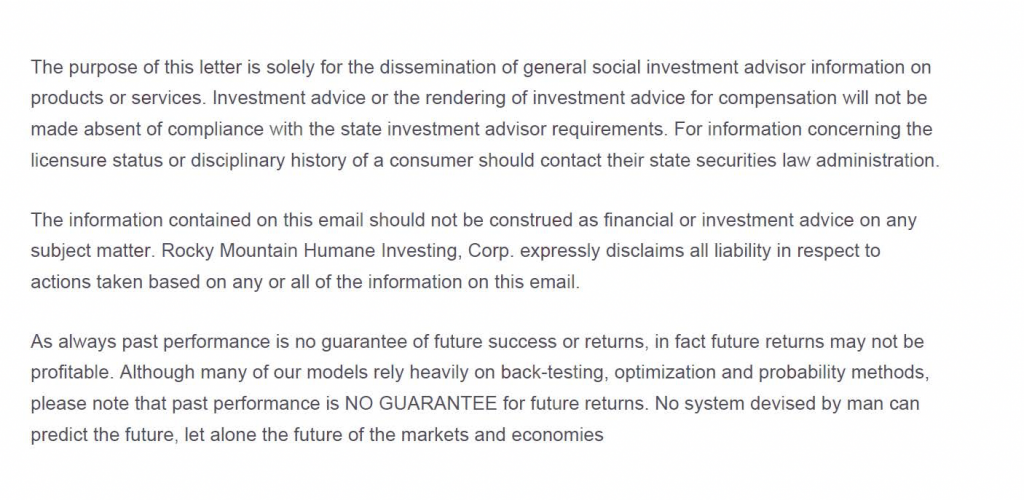

The Pivot to Re-Opening and Value

“Value” is a loosely defined term that means the shares a particular slow growth company are inexpensive relative to either a balance sheet, assets or earnings. “Growth” is the opposite with expensive valuations but they are high growth businesses. Growth has dominated for the past 10 years but the coming 12 months will be ideal for “Value” as the economy opens wide in the second half and interest rates rise. As the chart below shows the disparity between Growth and Value stocks is at a truly historic level. Some sort of Mean-Reversion should be expected.

For the past month or so trading Growth stocks seems like a zero-sum game. But Value and recovery stocks have been much steadier albeit slower, which is fine.

A rise in interest rates is beneficial to banks and many other financial stocks (which are Value stocks). This is not a prediction any more since it is already happening. Rising rates are indicative of an improving economy and job growth. Should a fiscal stimulus plan occur in the 1st Q of 2021 along with a potentially explosive economic rebound in the 2nd Q 21 the rise in interest rates could be much larger than anticipated. This is why owning banks is important now. The consensus is that interest rates are going to be “lower for longer”. That may be true for short term rates but inaccurate for long term rates.

The list of stocks that I considered my favorites for recovery in the late Spring and early Summer this year finally began to gain traction.

In addition to Banks and Financial stocks: Travel related stocks took off as well. Sabre and Expedia began a rise that confirmed my thesis that the hardest hit investments of Covid have a very favorable risk return longer term.

Our banks are PNC, Synovus and Comerica. All of our “Value” holdings are long term oriented. They may be sold from time to time but my perspective is to hold them until next year when the post Covid economy is obvious to all.

The post-Covid reopening stocks are being led (appreciation-wise) by travel companies Sabre, US Global Jets, Uber and Expedia.

In addition I added a starter position in Planet Fitness (PLNT) on 12/3. PLNT was an excellent Growth stock in years past and was obviously devastated by gym closings. PLNT appears to be in the initial stages of emerging from a long term bottoming process.

Howard Hughes Corp. (HHC) which is another Covid ravaged stock which we have a modest gain on is in corporate real estate. I call it the “anti-zoom” in reference to Zoom Video stock which was the darling stock of the Covid era. HHC is selling for just above Book Value which is $66.85 which includes $15 a share in cash. I’m not sure if it goes back to its February high of $130.

HHC’s largest shareholder is the shareholder activist Bill Ackman of Pershing Square. Ackman tried to lure Elon Musk and Tesla a few months ago to the HHC office space in Texas. It didn’t work but Ackman is very motivated to fill the empty space he acquired on the cheap.

Bitcoin

The narrative for Bitcoin is changing rapidly as it gains credibility within the 0% interest rate money market world. It is in the process of source of value for large corporations who see the limitations of Fiat based currencies. (Fiat currency is a currency backed by a government like the US dollar or the Swiss Franc)

Why? A paraphrased story goes somewhat like this: A very large international company, let’s say based in Switzerland is faced with a dilemma. The Swiss banks started to charge cash held in their accounts at a rate of .75% per year. Not only are they not paying interest but charging for holding cash in accounts.

Plus, the banks forbade the companies from withdrawing the funds in cash. You could do a bank to bank transfer but not in the form of actual currency. That didn’t sit right for anyone – other than the Swiss banks.

A partial solution emerges with Bitcoin and other Cryptocurrencies. Companies have begun to pull funds from banks and have begun storing cash in Bitcoin and other Crypto’s.

Companies like Square and Paypal have begun to accumulate Bitcoin for its long term transaction potential.

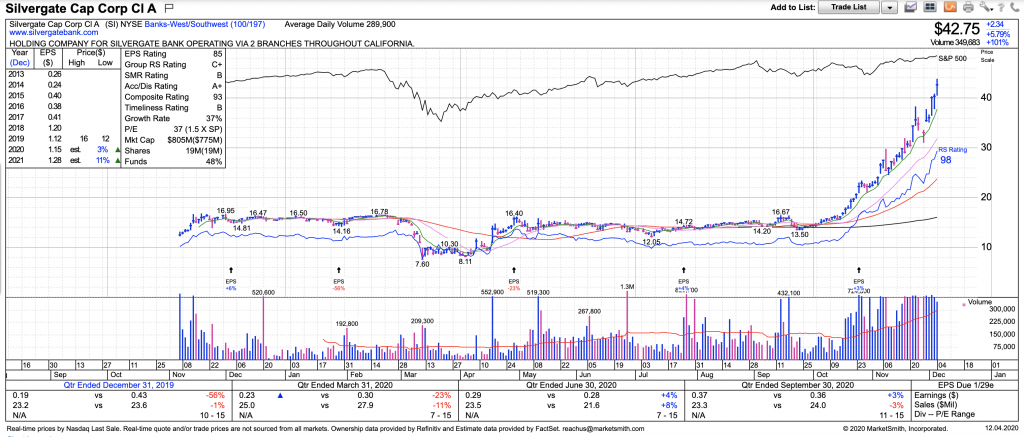

Silvergate Capital Corp. Symbol SI

SI is still relatively undiscovered by large investors and I doubt it will remain public or unknown for very long as its a very attractive takeover target. Because of Silvergate’s unique target markets and niche I could easily see a much larger traditional bank such has JP Morgain buying out SI.

Silvergate is the “go to bank for Cryptocurrency” banking and trading. They’ve created the Silvergate Exchange Network (SEN) which allows for 24/7/365 crypto trading in US dollars. No more weekend or holiday delays.

At Silvergate you can earn interest on your Bitcoin holdings up to 6% plus the Bitcoin assets can be stored in something like a deep freeze until you need to use it.

Our original entry price was $24 and I’ve accumulated more as the stock confirmed its strength. I have placed tight stop loss orders with preserving the gains in mind. Even still, this is a long term holding.

Natural Order Acquisition Corp. Symbol NOACU

NOACU is a new Initial Public Offering of what is commonly called a Blank Check company. Meaning there is no actual operating business at the moment but the company intends to buy or acquire business within its target market. In the case of NOACU the target market is Plant Based Food and meat alternatives.

We bought in right after the offering went public so this is a long term story. Eventually they’ll be buying and supporting plant based food companies. We’ll see how it goes.

Thats all folks.

Be Safe and Kind

Brad Pappas

December 3, 2020

We’ve updated our Vegan Growth Portfolio model results with the data through Dec 7, 2020.

We’ve updated our Vegan Growth Portfolio model results with the data through Nov 2, 2020.