Vegan Growth Portfolio Model results updated through March 31, 2020

We’ve updated our Vegan Growth Portfolio model results with the data through March 31, 2020.

We’ve updated our Vegan Growth Portfolio model results with the data through March 31, 2020.

We’ve updated our Vegan Growth Portfolio model results with the data through March 1, 2020.

We’ve updated our Vegan Growth Portfolio model results with the data through February 3, 2020.

“Markets are never wrong, only opinions are”

Jesse Livermore

January 27, 2020

Jesse Livermore was amongst the first great stock traders of the early 20th Century. One of his basic concepts is that we trade markets and individual holdings. An investor should have little concern for opinions and anything else that can distract from following price. If this current market proves one thing it’s: Markets and economies are two different things and don’t necessarily have to correlate.

If you think this means I’m not going to lay out my thoughts to you of what I think may happen, you’ll be right! All of my best performance years occurred when I kept my blinders on and didn’t listen to anyone. Instead I reacted to market signals and price changes when they occurred rather than trying to anticipate the future.

Last October the stock market proved that I was wrong with my belief that we were in the mire of a long term market topping process. This opinion was backed up by a substantial amount of weak economic data that under normal conditions should have led the US into a recession this year.

Keep in mind the data is still pretty bad but it has been offset by $60 billion per month and almost $400 billion in aggregate in Treasury assets (The Fed buys the Treasury security and pays the seller with cash, who in turn can buy stocks).

In my opinion there is an unholy alliance between the Fed, Mnuchin and the President to keep the stock market rallying into the election as if it were a matter of national security.

Markets and many stocks have gone “Parabolic”. I use the term Parabolic on occasion when necessary. One of my most important rules is: Parabolic moves in stocks, markets or any other asset are unsustainable and burn out quickly but the timing of peak price is unknown.

Assume its impossible to accurately predict when the parabolic bubble bursts – my intent is to play this move for all its worth and be prepared to exit fast. The decline from a parabolic move is usually quite deep. I would be looking for a decline of 15% to 20% sometime this year.

Tactically I’ve taken a middle of the road approach by using tight stop loss orders. So as a stock like Virgin Galactic or Beyond Meat may leap higher, my stop loss prices move accordingly just under the stock price.

Current portfolios have a solid group of core growth stocks that comprise the majority of our holdings. Stocks with multi-year uptrends and reliable earnings growth make this list. Holdings considered “core” include: Fair Isaac, Copart, Mastercard and Visa, Global Payments and Adobe, Cable One, etc. Since I’m not expecting a long term bear market, these stocks can be held and hedged should the market turn down.

Approximately 20% in aggregate of our allocation is devoted to the fast and furious movers like Beyond Meat, Virgin Galactic, Sea Ltd and Audiocodes, etc. These have already made large moves and will be sold quickly should they show signs of declining with the market selloff.

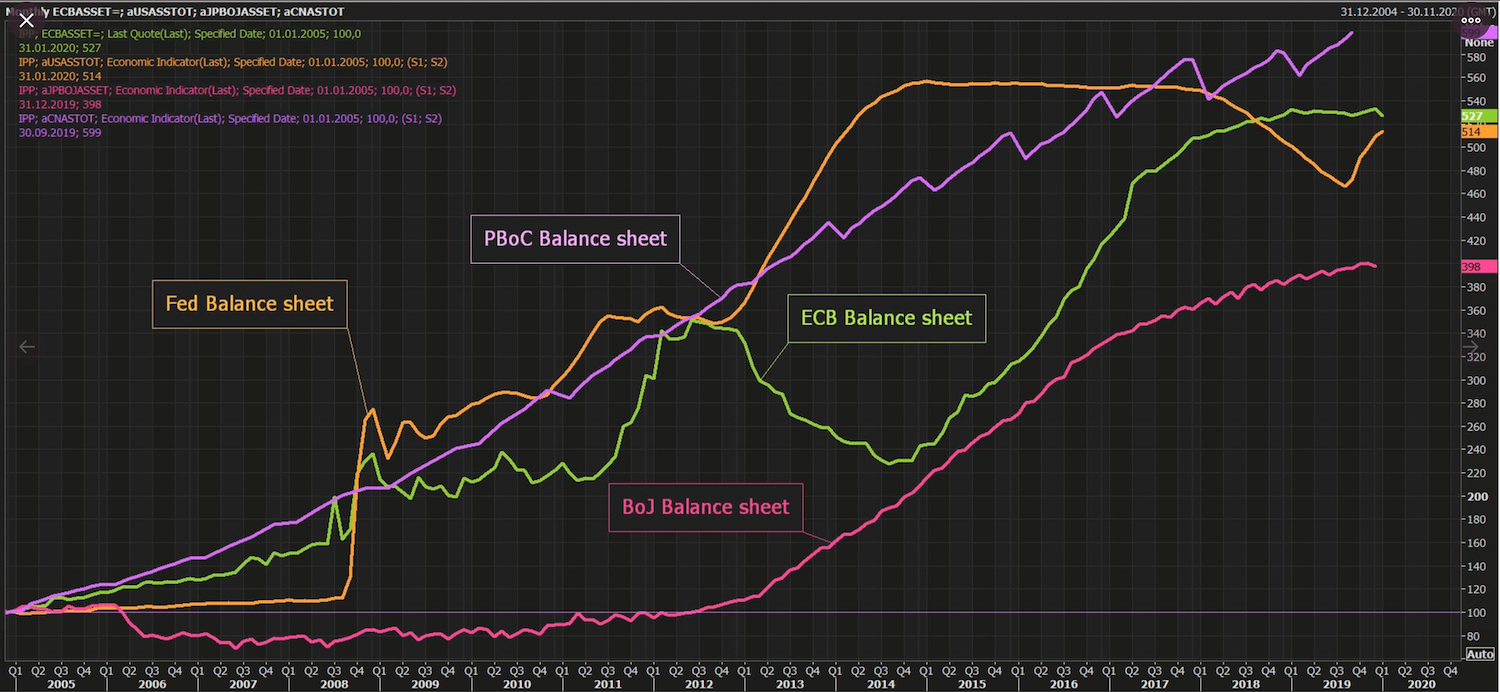

It used to be that market timing via Federal Reserve policies was difficult but still possible. But that’s a thing of the past as we are in the midst of the greatest amount of central bank cash infusion since the Great Recession 10 years ago. World central banks are trying to avoid a recession by swamping credit markets with cash. In doing so, much of the cash goes into the stock market as banks and funds lever up and push the markets higher regardless of the lack of earnings growth and a slowing economy.

January 27th, 2020: Seemingly out of nowhere at least three issues have emerged which are causing the stock market to roll over.

1. The rise of Bernie Sanders is polling. As you’re probably well aware, Bernie has moved ahead of Biden in many states. His popularity creates a stark economic contrast to what presently passes for economic policy. Investment markets are discounting entities – in other words, markets will begin to move one way or another till November depending on which candidate is the perceived winner. DJT’s policies are positive for stocks in the short term while Bernie Sanders presents a severe headwind for the future.

In anticipation of a Democratic winning in November, I would anticipate higher capital gains taxes in the future – this is one of the prime reasons for the core Growth stocks mentioned earlier. It is my hope they can be held in excess of a year to qualify for the long term capital gains rate.

If your account is in a non-taxable IRA or Rollover, these core holdings will still be a benefit long term – unless the Fed pivots from ultra easy policy to inflation-motivated tightening.

2. The Coronavirus: Aside from the obvious potential lethality and its effect on travel, trade and healthcare, the virus represents another hurdle for supply chains. Last year I wrote about how important supply chains are for manufacturing productivity. They have been significantly disrupted by the unending Trade wars. Now, the Coronavirus present another issue compounding the issue. Will this final straw to move US manufacturing out of China to someplace local?

3. The Fed has begun to reduce its capital flows. I’m willing to bet they’re thinking twice about that choice now. The rise in stock prices in the 4th Q of 2019 was not due to any economic rebound. It was due to the Fed adding massive liquidity (cash) to the banking system. Last week they started to ease off.

As I mentioned earlier, this government does now want to see natural price discovery for the stock markets as that would give the Democrats and edge. So I wouldn’t be surprised to see the Fed go back to their $60 billion goal should stocks get hit hard.

Sell Signal: My proprietary models are beginning to show that it’s time to sell a portion of stocks and use the cash balance for hedges. My goal is to minimize net losses for what may lay ahead. Considering the magnitude of the move higher since October this isn’t surprising but I would like to protect as much of our January gains as possible. At that point we can allow the selloff to evolve with some peace of mind.

Brad Pappas

January 27, 2020

We’ve updated our Vegan Growth Portfolio model results with the data through January 2, 2020.

Value Stocks Risk/Reward

November 12, 2019

An issue I haven’t mentioned this year has been the profound weakness in Growth stocks since August. Most of the hot running high momentum stocks from earlier this year have been taken to the woodshed.

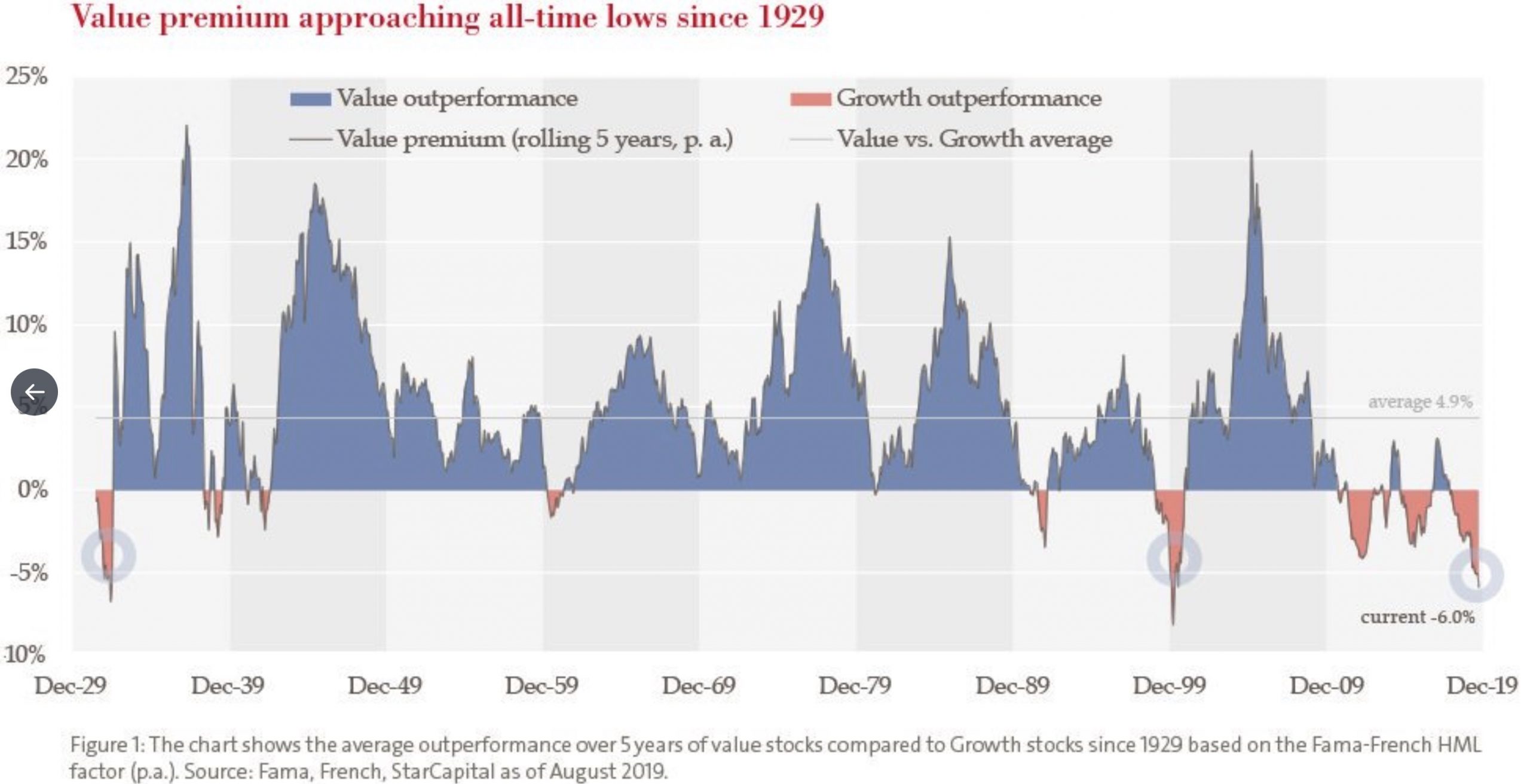

One of the reasons for money migrating out of high growth stocks is that the valuations became extreme relative to Value stocks. If there is once concept that investors in every asset class must understand is Mean Reversion. Prices always revert back to their long term trends. Think of the Tech Stock bust in 2000. The money from the sale of the overvalued Tech stocks went into Value stocks.

When I refer to “Value” stocks what I’m referring to are stocks that are cheap or have a low value relative to the underlying company. These are companies that are slow growth growing only single digits percentages a year. They can be boring businesses that don’t have a lot of sizzle to their story unless you’re a numbers geek like I am.

Right now the Risk/Reward is heavily skewed to Value stocks. The Value universe of stocks include a hefty percentage of banks and insurance companies. These financial companies saw their valuations compressed due to very low interest rates and the Inverted Yield Curve.

As you can see the Value stock methodology had dominated performance until the Great Recession of 2008. The lack of performance from Value does coincide with an uptick in activity or manipulation by the Federal Reserve.

What can’t be denied is that interest rates have moved higher which can increase profit margins and loan growth for banks and insurance companies.

Brad Pappas

November 12, 2019