Vegan Growth Portfolio Model results updated through January 2, 2020

We’ve updated our Vegan Growth Portfolio model results with the data through January 2, 2020.

We’ve updated our Vegan Growth Portfolio model results with the data through January 2, 2020.

Value Stocks Risk/Reward

November 12, 2019

An issue I haven’t mentioned this year has been the profound weakness in Growth stocks since August. Most of the hot running high momentum stocks from earlier this year have been taken to the woodshed.

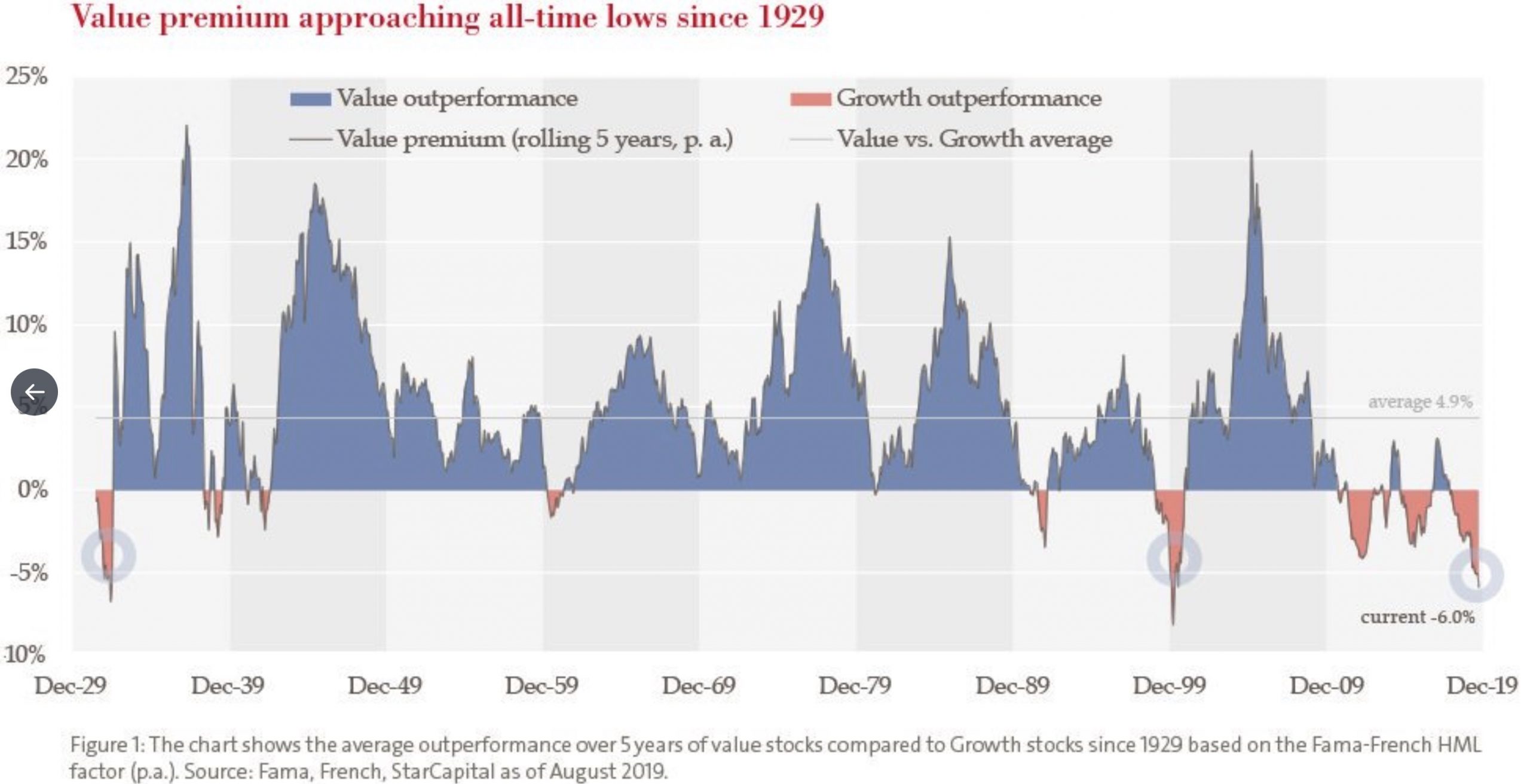

One of the reasons for money migrating out of high growth stocks is that the valuations became extreme relative to Value stocks. If there is once concept that investors in every asset class must understand is Mean Reversion. Prices always revert back to their long term trends. Think of the Tech Stock bust in 2000. The money from the sale of the overvalued Tech stocks went into Value stocks.

When I refer to “Value” stocks what I’m referring to are stocks that are cheap or have a low value relative to the underlying company. These are companies that are slow growth growing only single digits percentages a year. They can be boring businesses that don’t have a lot of sizzle to their story unless you’re a numbers geek like I am.

Right now the Risk/Reward is heavily skewed to Value stocks. The Value universe of stocks include a hefty percentage of banks and insurance companies. These financial companies saw their valuations compressed due to very low interest rates and the Inverted Yield Curve.

As you can see the Value stock methodology had dominated performance until the Great Recession of 2008. The lack of performance from Value does coincide with an uptick in activity or manipulation by the Federal Reserve.

What can’t be denied is that interest rates have moved higher which can increase profit margins and loan growth for banks and insurance companies.

Brad Pappas

November 12, 2019

Still Weighing The Evidence

October 7, 2019

During potential client interviews over the past 6 months or so I’ve noticed some questions I don’t normally have to account for. The questions usually boil down to how come our returns are not as strong this year as in the recent past.

Generally speaking, these kind of questions come from investors who (whether they know it or not) have shorter term time horizons than I presently do.

My issue with shorter term investors at the moment is that the longer term business cycle data is turning down. This evolving negative data is a significant reason for caution. Plus, I don’t feel compelled to invest in stocks for what could be a very short time window before a significant decline.

In addition, we have a unique situation where the major market indices are now negative for the past 12 months. This is aside from the fact that equity markets are beholden to unpredictable tweets and lies plus a trade war that isn’t going away any time soon and a Federal Reserve behind the curve.

The chart below is the Value Line Arithmetic Index. This index gives an equal weighting to all stocks which is very different from the commonly used S&P 500. The VLE is a more accurate depiction of what the average investors portfolio has returned. There are 4 declining tops and the highs of September ’18 remain the market peak. This is not encouraging at all.

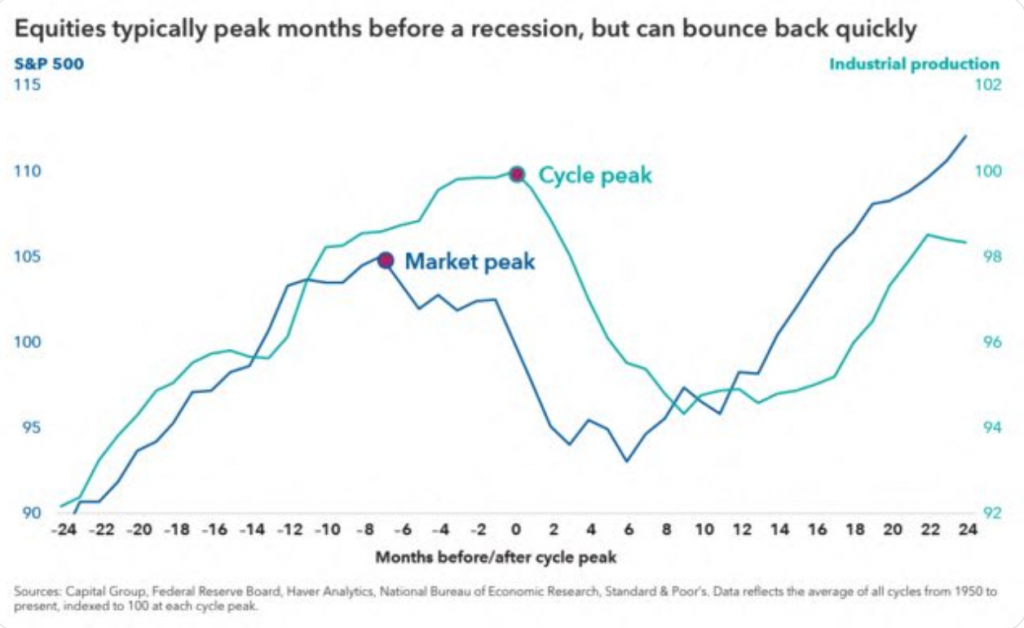

Trying to gauge the direction of the economy and financial markets is hard. Markets are anticipatory entities with a long history of moving before the underlying economy makes its own move. These unanticipated moves can leave investors flat-footed in their decision making. But in my view better to be early than late.

Could we actually be in the midst of a recession now? It’s possible, but the data is not conclusive.

The current investment consensus remains sanguine that we’re in a mid-cycle soft patch like 2016 and that growth will accelerate in the 4th quarter. This is one of the reasons why stocks haven’t caved despite the daily and medium termed data that continues to suggest we are at the end of this business cycle.

3 data points I’m watching:

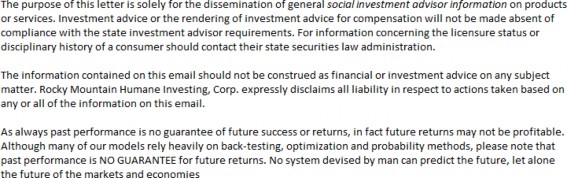

The ISM Manufacturing and Services Index

Earlier this week the ISM Index for manufacturing went below 50, a level that corresponds to negative manufacturing growth. It hasn’t bottomed yet but note the fairly tight correlation to stocks.

Manufacturing is only 11% of the US economy but its usually one of the first indicators to signal an incoming recession. When manufacturing slows, the Domino effect eventually hits transportation and shipping before it seeps into the rest of the economy. In my last letter I mentioned that the Cass Freight Index had already dipped into recession territory signaling a recession in the 4th quarter of 2019.

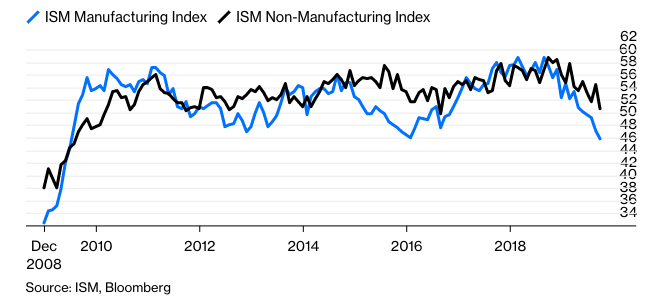

Initial Jobless Claims

Initial jobless claims is a refection of the health of the labor markets and moves in advance the official unemployment data. So far, the IJC has not moved higher which is a positive but at present it is at such a level that it cannot decline much more.

In addition, the low rate of unemployment and IJC is a serious reason for why it would be very difficult to strengthen the economy, because the employment levels are already so high. During the soft patch in 2016 unemployment peaked at 5%, which allowed some margin for improvement. We are currently at 3.5% which implies any stimulus could only have a marginal effect.

CEO and Consumer Confidence

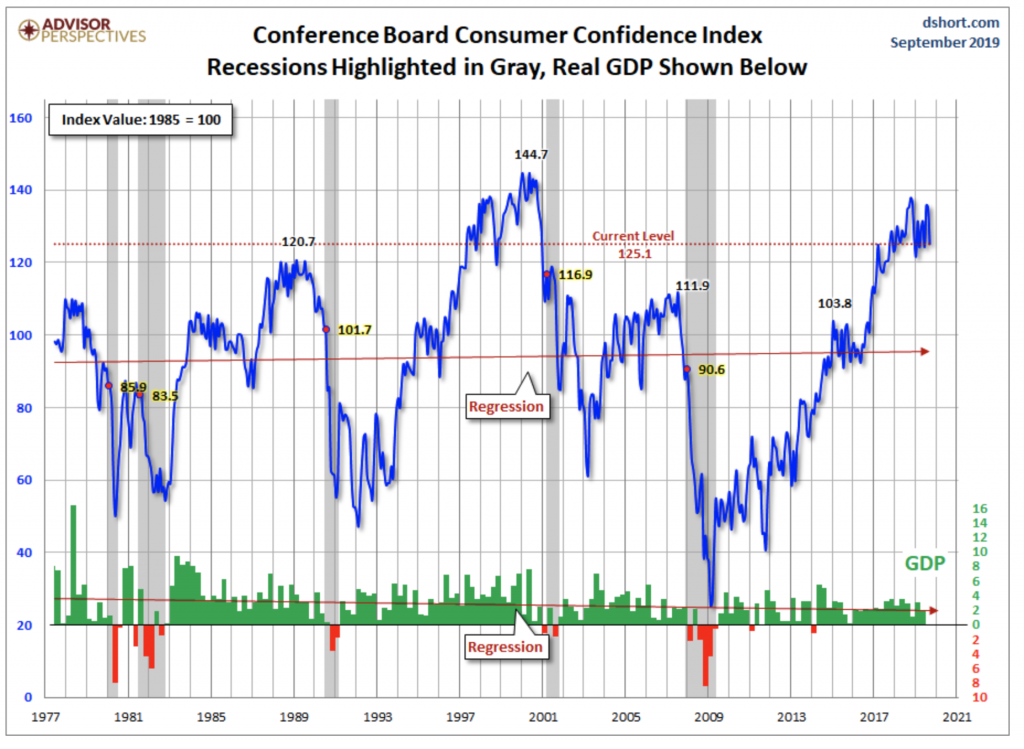

Stock market peaks and consumer confidence peaks go hand in hand. Consumer confidence peaked in 1988, 2000 and 2007 and in all cases returns were much worse than average.

At present consumer confidence shows some early signs of peaking but it hasn’t rolled over yet. Regardless of where we stand today, confidence peaks at the consumer level are followed by recessions.

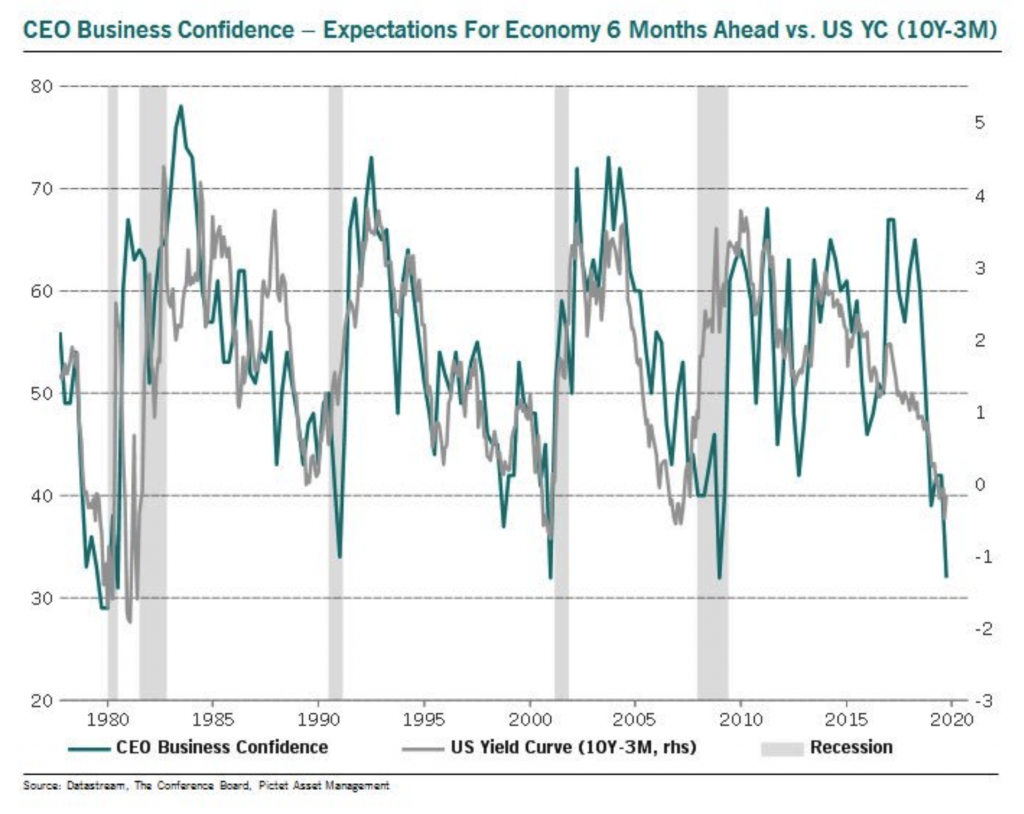

Of particular interest is the confidence levels for CEOs who are in contrast to the Consumer. CEO confidence is in the pits. CEOs aka Insider Sales have been very strong in the past months as they are rapidly lightening exposure.

CEOs are likely to begin cutbacks in Capital Expenditures and this may account for the weakness in software stocks and other aggressive Tech stocks.

Brad Pappas

October 7, 2019

Published for clients on July 23, 2019

If we look back over the last 40 years, there have been relatively long periods in which the stock market behaves in a certain way which we could call positive or bullish behavior. Human nature tends to adapt to this behavior and extrapolates into the future to the point of unsustainable excess. At the peak of this excess, the market behavior shifts into a new paradigm in which the markets operate in the opposite of the previous trend. For example, expansive credit which leads to excessive debt loads gives way to restrictive credit and debt reduction. Companies that thrived on expanding debt can find themselves having difficulty paying the interest on their debt.

Identifying and navigating these shifts from expansive credit and debt to restrictive credit and debt reduction is generally the underlying shift from an expanding economy to a recession. Identifying these shifts is not that difficult but the timing of the shift is tricky. Navigating these shifts and restructuring portfolios to avoid the downside of the shift is the prime reason behind my management style. Identifying the future shift in credit and the economy is the foundation of creating an All-Weather investment portfolio.

Managing the shift is also critical to the long term success of the investor. Managing the shift well keeps the investors emotions in check and places them well to take advantage of the eventual shift to expansive credit and a growing economy. A common but untrue belief in the retail investment industry is that to increase return you must increase risk. My view is that shifting portfolio structure to reflect a new economic paradigm can generate a higher than average return since an investor could avoid much of the decline in static 60%/40% (common retail brokerage firm recommendation).

—–

Despite my growing concern for the US and Global economies into 2020 we remain invested but reducing our ownership in stocks. This is because of a cardinal rule when investing: “Don’t fight the Fed” and “Don’t fight the tape.” Markets don’t care what I think and sometimes it’s easier to avoid the headline news and just focus on price and trend. But that would make for awfully short client letters.

When you read most market commentary the commentators are usually making a prediction and validating the prediction with opinions. This type of investment process generally leads to losing a great deal of money and lagging performance.

My perspective has been to wait until a trend change occurs and then act upon an opinion of a likely outcome. So I’ll continue to remain in stocks until I see some sign that price and trend are turning down. While I do believe a recession will occur soon, I have no idea as to the timing.

As economic conditions continue to worsen investors are relying on the power of the Federal Reserve and other Central Banks to drive asset prices higher. There is an ever widening gap between stock prices and economic growth. Treasury bond strength see right through the disparity with their strong price trends.

Despite the high odds of a 2020 recession, it does not mean that stocks should be sold ASAP. There is still time for stocks to rally but the window is likely a matter of months to a year. This means we have to pay extra attention to risk control and follow the incoming data.

On the bright side, the bull market trend is still intact and my suspicion of there being a triple top in stocks is in danger of being wrong. As of 7/11, I’m not seeing any strong signs of selling or distribution. But this is often the case near the end of a bull market as bull markets can end in an upward frenzy. With the Fed to cut rates by .25 this month a “melt up” is a distinct possibility. Perhaps not as severe as 1999-2000, but a wave worth riding.

Regarding the rate cut, I believe it’s also true that the instability created by Trump’s trade wars and its effect on supply chains will be the event that pushes the US into recession. For corporations over the last decade there has been a mass decision to move to China for manufacturing since the cost of labor was below the US “Labor Arbitrage”.

Suddenly companies are faced with a US policy that creates enormous doubt over the future. Can a company move from China to Mexico? I don’t know. Can it move to Canada? Who can say? What about India? This spells the end of Globalization as we knew it and it’s replaced with unrealistic nativism and doubt. It’s not that trade will end but the biggest factor is the rate of change as manufacturing slows or stops while hoping to find some answers.

Around the world corporations ask themselves: “Can we outlast Trump?” “We can go on a buying binge to build inventory? But eventually we’ll deplete ourselves, what then?” Does Trump go? If not, do we have to pull the plug and rebuild in the US?

This process takes time and will likely have the effect of slowing growth and may be the catalyst for a Recession.

So, in effect, Powell is trying to save the economy from the damage created by the Orange Menace.

But the reality is the Fed has only been successful in halting a recession with rate cuts 25% of the time. The business cycle is real and not easily averted, so the perception that Central Banks are all-powerful is sadly mistaken.

Of special note in this cycle is the lack of leverage the Fed currently has. Historically, the Fed has cut rates by an average of 5 full percentage points. On this go-around they only have 2.5% before we reach 0%.

Because of the lack of leverage by the Fed, the next recession could be especially harsh as stocks will likely have to find their own level to the downside with only modest Fed intervention.

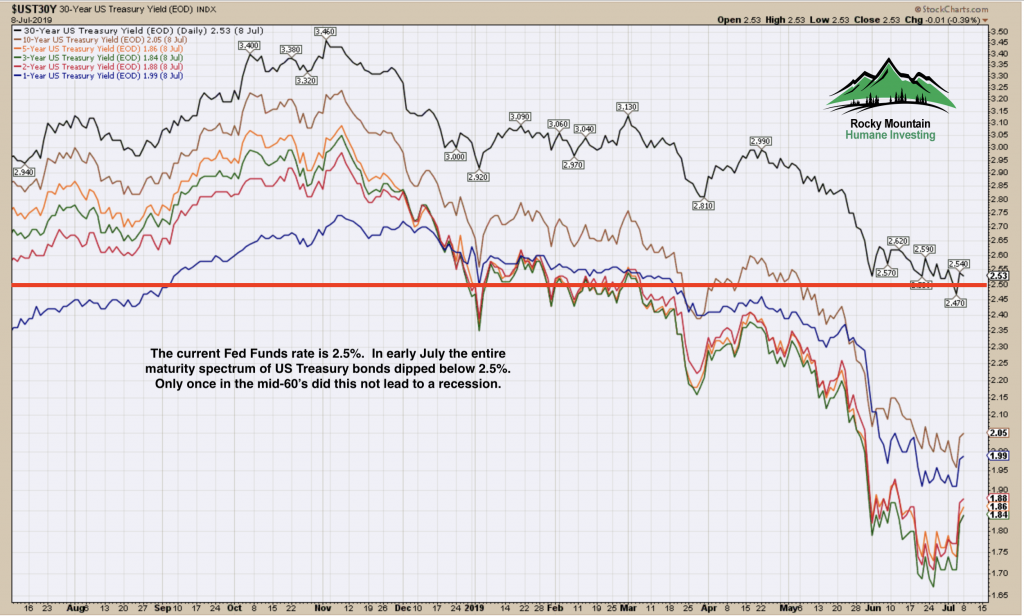

The Treasury Bond market is screaming recession.

The chart above highlights that the entire range of US Treasury bond yield is either at or below the Fed Funds rate of 2.5%. This is a phenomena typically seen before a recession takes place. Investors are migrating away from risk assets to safety.

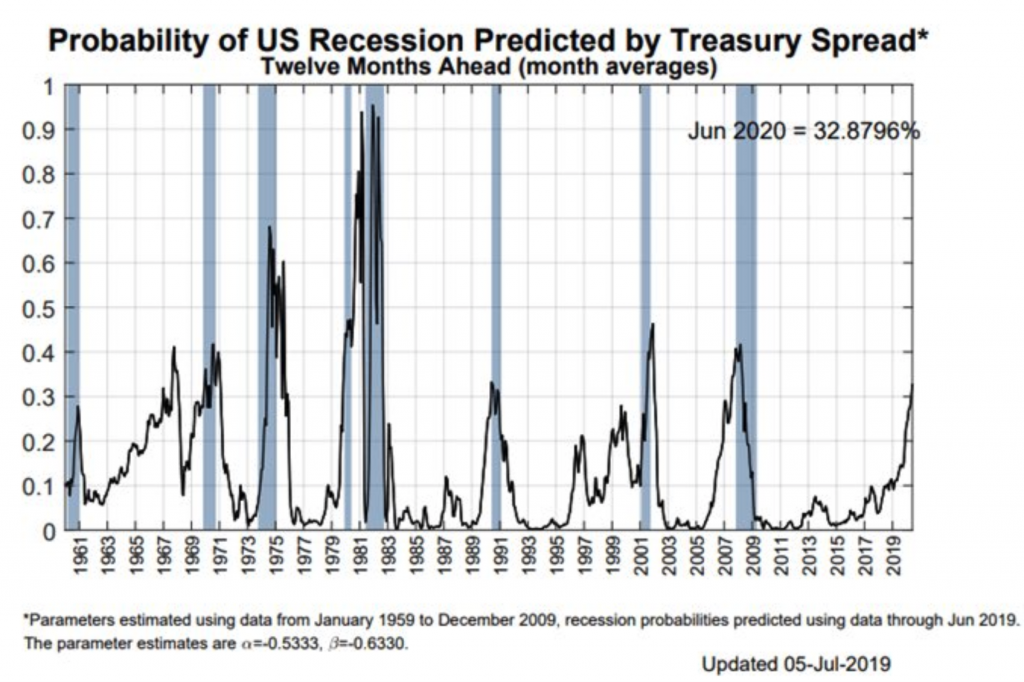

The chart above depict what all the fuss is about. Due to the yield inversion, the New York Federal Reserve recession odds estimate is now at 32.87% and rising. Economically, this means little right now but watch out in 6 to 9 months. Meanwhile, stocks should begin to show weakness soon. With the exception of the Summer of Love, reaching beyond 30% has been the point of no return for a recession and very bad news for stocks.

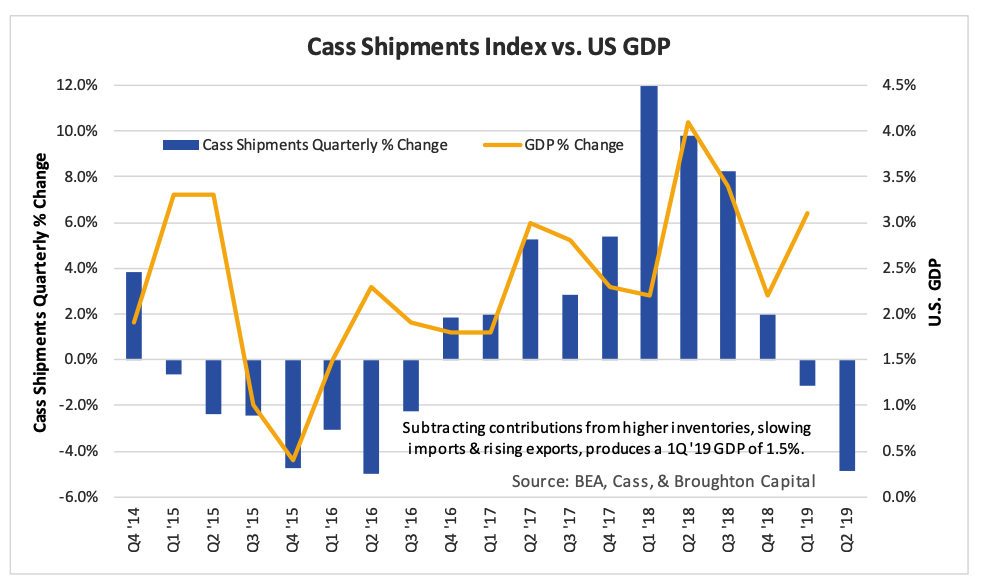

In addition, the Cass Freight Index Report which measures freight volumes and is a good measure of industrial activity. It’s an early indicator and generally leads US GDP by about six months.

Cass is increasingly concerned that the global slowdown is spreading to the US and that trade disputes are “reaching the point of no return”.

From Cass: “Based on all three months of data for Q2 the Cass Shipments Index is signaling GDP may be negative, or at least come close to being negative in Q2. If it does not, since reported GDP often lags economic activity represented by Freight flows, continued weakness in the Cass Shipments Index at the current magnitude should result in a negative Q3 GDP.”

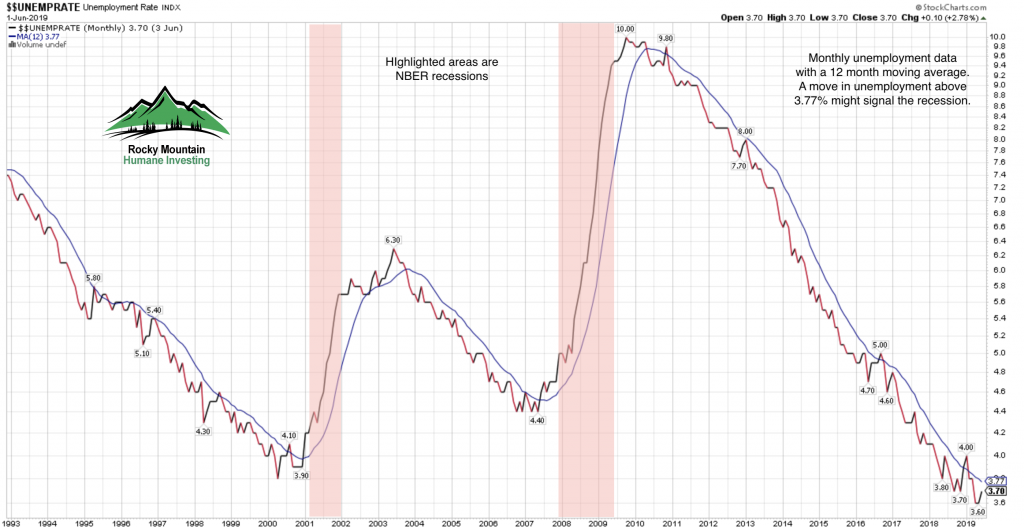

Unemployment is a lagging indicator and always looks great at cycle peaks. But is also a pretty good timing mechanism for stocks and recessions. All I can say for now is that a potential bottom may be in place but it’s too early to know for sure.

It would be such a cliche to think “this time is different” especially for an economic expansion as long as this one. Plus, I have no reason to believe the NY Fed has it wrong. The question that should follow is: What will be ground zero for this recession?

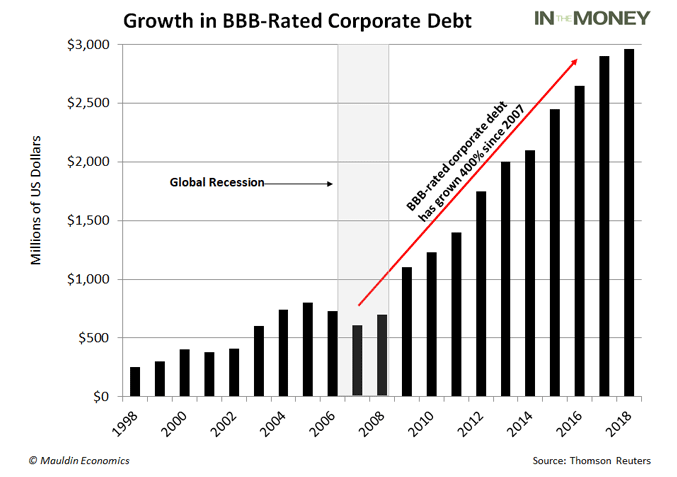

The answer in the past was the S&L Crisis in 1991, Tech stocks in 2001 and subprime home lending in 2008. Generally the most exploited investment sectors have the potential for implosive losses. From the information I have been able to gather, the likely poster child for the next recession is BBB rated Corporate Debt.

BBB is the lowest rating a bond can be rated and still be considered Investment Grade. Over half the corporate debt issued is now BBB and the next level lower is considered “junk”. The reasons for this explosion of debt are many but perhaps the most significant reason is the extremely low interest rates.

But corporate revenues used to pay debt are cyclical. Human nature tends to have a “recency bias”. In other words, people don’t bother anticipating a dip in revenue due to recession because things look great at the moment.

How was the debt used? Mostly for stock share buybacks which in recent years has been the largest net purchaser of stocks. So companies look at the cheap cost of adding debt to buy back their shares of stocks and merge with other companies.

But what happens when the business cycle ends? Revenues decline and the ability to service the debt or lower their leverage becomes more difficult and this is where it gets nasty.

If one of these companies comes close to not being able to service their debt when the economy weakens their debt will be downgraded below BBB.

And, it would mean that presently the largest group of buyers (corporate stock buybacks) of US stocks would disappear. This could get nasty very quickly if the Fed is too slow to act. IMO the Fed needs to cut by more than just .25

Because of how Investment grade bond funds and ETFs are managed, if BBB debt is downgraded, these funds (plus pension funds, insurance companies, banks etc) will be forced to sell their newly downgraded debt. But to whom?

The Junk bond market trades much different from the investment grade market and it’s also much smaller. The Junk bond market is valued at $1.2 Trillion and that is less than half the size of the BBB market.

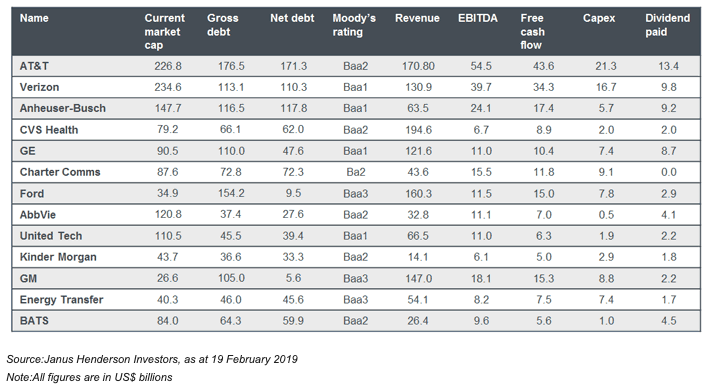

The list above is the list of the most vulnerable BBB rated companies who’s debt could be downgraded in a recession.

If Ford, AT&T, GM and GE were forced below BBB, their combined debt would be just under 50% of the entire Junk bond market. This would likely create a free fall on their bond values as there would likely be “no bids” for many of the bonds — just like the Subprime mortgage collapse.

Despite everything I’ve written there will be asset classes that will work into the next recession and what I believe will be the eventual currency debasement of the US Dollar. The subject of debasing the USD will be for a future letter but in the case of Europe and Japan, when they went to 0% or negative interest rates, the Monetary base exploded. Central banks printed money at such a pace that the underlying value of their currencies suffered. In our country we have massive debts in pensions and healthcare. One way to solve these debts is to nationalize them if they’re not already and crank up the money printing machine.

Consider what I mentioned earlier regarding a potential tidal wave into the Junk bond market from the auto and communication companies. Could Ford and GM become nationalized? My guess is the public is sick and tired of bailing out the auto companies and the US government might just take them and their debt private.

So what works going forward?

Summary

Market and Business Cycles matter. It’s easy to forget they exist when you’re in the 10th year of an expansion but all expansions eventually end. I would expect that sometime near the end of 2020 we’ll begin to see the emergence of a new market and business cycle. But in the meantime risk is very high. It’s my responsibility to steer us through the cycle end with our assets intact ready to take advantage of the dream opportunity to invest in an early stage recovery.

All The Best,

Brad Pappas

We’ve updated our Vegan Growth Portfolio model results with the data through June 30.

We’ve updated our Vegan Growth Portfolio model results with the data through May 31.