Still Weighing The Evidence

October 7, 2019

During potential client interviews over the past 6 months or so I’ve noticed some questions I don’t normally have to account for. The questions usually boil down to how come our returns are not as strong this year as in the recent past.

Generally speaking, these kind of questions come from investors who (whether they know it or not) have shorter term time horizons than I presently do.

My issue with shorter term investors at the moment is that the longer term business cycle data is turning down. This evolving negative data is a significant reason for caution. Plus, I don’t feel compelled to invest in stocks for what could be a very short time window before a significant decline.

In addition, we have a unique situation where the major market indices are now negative for the past 12 months. This is aside from the fact that equity markets are beholden to unpredictable tweets and lies plus a trade war that isn’t going away any time soon and a Federal Reserve behind the curve.

The chart below is the Value Line Arithmetic Index. This index gives an equal weighting to all stocks which is very different from the commonly used S&P 500. The VLE is a more accurate depiction of what the average investors portfolio has returned. There are 4 declining tops and the highs of September ’18 remain the market peak. This is not encouraging at all.

Trying to gauge the direction of the economy and financial markets is hard. Markets are anticipatory entities with a long history of moving before the underlying economy makes its own move. These unanticipated moves can leave investors flat-footed in their decision making. But in my view better to be early than late.

Could we actually be in the midst of a recession now? It’s possible, but the data is not conclusive.

The current investment consensus remains sanguine that we’re in a mid-cycle soft patch like 2016 and that growth will accelerate in the 4th quarter. This is one of the reasons why stocks haven’t caved despite the daily and medium termed data that continues to suggest we are at the end of this business cycle.

3 data points I’m watching:

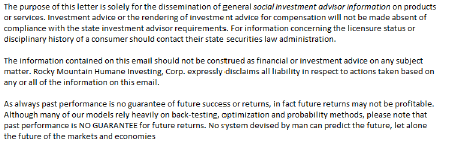

The ISM Manufacturing and Services Index

Earlier this week the ISM Index for manufacturing went below 50, a level that corresponds to negative manufacturing growth. It hasn’t bottomed yet but note the fairly tight correlation to stocks.

Manufacturing is only 11% of the US economy but its usually one of the first indicators to signal an incoming recession. When manufacturing slows, the Domino effect eventually hits transportation and shipping before it seeps into the rest of the economy. In my last letter I mentioned that the Cass Freight Index had already dipped into recession territory signaling a recession in the 4th quarter of 2019.

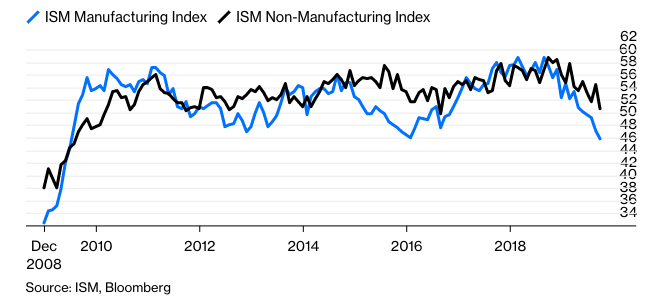

Initial Jobless Claims

Initial jobless claims is a refection of the health of the labor markets and moves in advance the official unemployment data. So far, the IJC has not moved higher which is a positive but at present it is at such a level that it cannot decline much more.

In addition, the low rate of unemployment and IJC is a serious reason for why it would be very difficult to strengthen the economy, because the employment levels are already so high. During the soft patch in 2016 unemployment peaked at 5%, which allowed some margin for improvement. We are currently at 3.5% which implies any stimulus could only have a marginal effect.

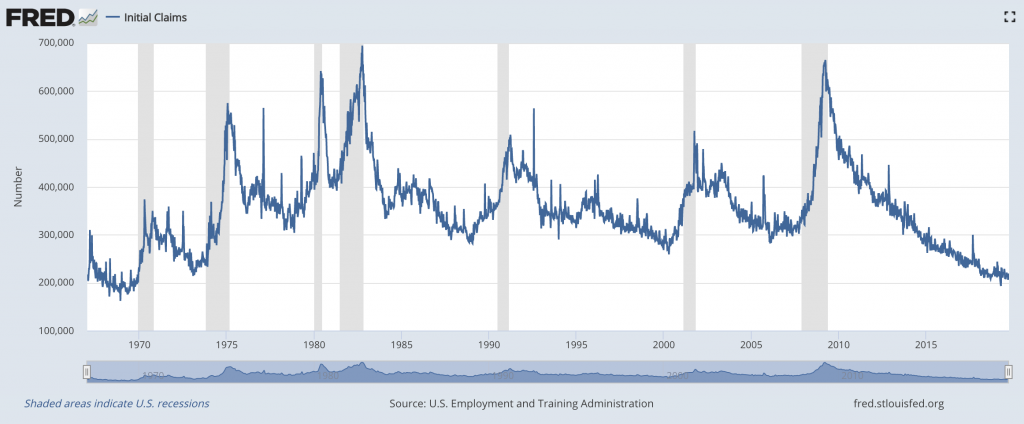

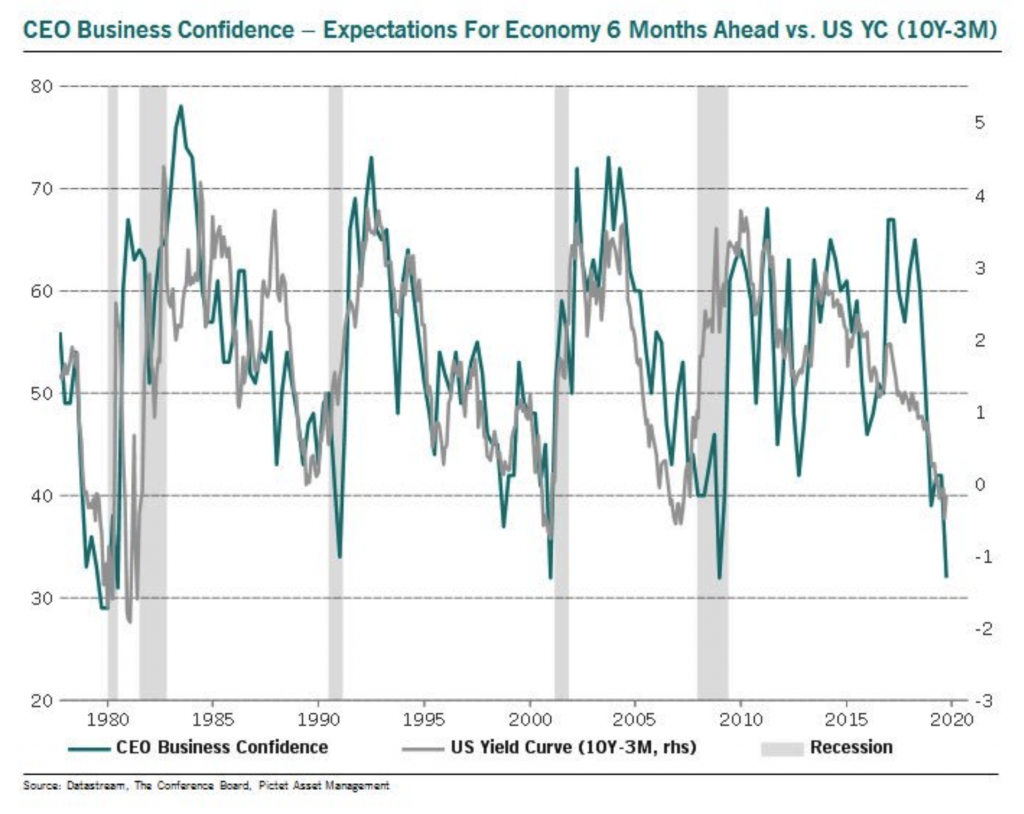

CEO and Consumer Confidence

Stock market peaks and consumer confidence peaks go hand in hand. Consumer confidence peaked in 1988, 2000 and 2007 and in all cases returns were much worse than average.

At present consumer confidence shows some early signs of peaking but it hasn’t rolled over yet. Regardless of where we stand today, confidence peaks at the consumer level are followed by recessions.

Of particular interest is the confidence levels for CEOs who are in contrast to the Consumer. CEO confidence is in the pits. CEOs aka Insider Sales have been very strong in the past months as they are rapidly lightening exposure.

CEOs are likely to begin cutbacks in Capital Expenditures and this may account for the weakness in software stocks and other aggressive Tech stocks.

Brad Pappas

October 7, 2019