Market Sell-offs Are Not Necessarily A Bad Thing

(especially if you have a lot of cash)

January 21, 2022

US Monetary Policy aka the posture of the Federal Reserve which has the greatest impact on investment valuations will turn negative this year. Hence raising short term interest rates is causing the stock market to selloff in the near to intermediate term.

Adding fuel to the sell-off is the Empire Manufacturing Survey is signaling the economy will being slowing down.

While the short and intermediate term trend for stocks is negative. Going forward high quality stocks are declining in value that will eventually lead to a very good long term opportunity. So, while the main theme of my letter is negative for investments, long term this sell off will likely create excellent opportunities. Plus, having client account at approximately 80%+ in cash will allow us to take advantage of the opportunity when the time is appropriate.

The Fed’s objective is changing to fight inflation rather than prioritizing economic growth and employment. The consensus is for 4 rate hikes of .25% in 2022 and 4 more in 2023. A full 1% hike in short term rates is frequently associated with a short term 15% decline in stocks.

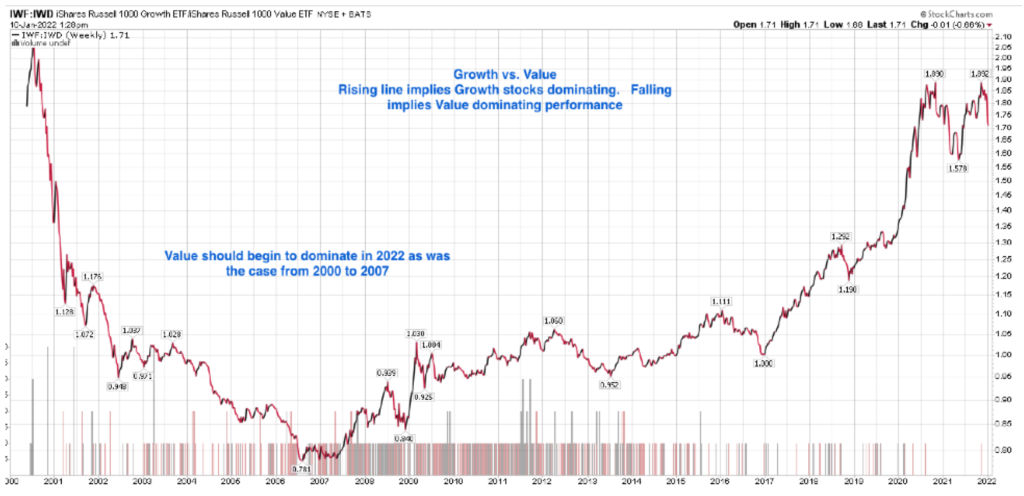

Due to the Fed’s new focus on raising short term interest rates, stocks have made a very hard pivot from Growth to Value. IMO, Growth and especially richly valued Tech stocks are in a Bear Market and untouchable for the time being. For example, the Ark Innovation ETF has fallen from $155 in February to $71 today.

This increases the odds of a market pullback to the 10%-20% range possibly in the first half of 2022 for the S&P 500. The Nasdaq Composite and especially richly valued Tech stocks could fall greater than 20%.

Aside from a special situation like ViacomCBS (which could be sold at +$60 per share this year to either Apple, Comcast, Amazon, Google) the Risk/Reward is unfavorable at the moment. But with stocks falling like lead weights they are progressively improving their risk/reward. More on the ViacomCBS situation below.

#1 The Growth Stock Bubble Has Burst: The anticipated end of the Growth stock bubble is at hand and not dissimilar to the bursting of the 2000 Growth stock mania. I have confidence in making this declaration because (just as was the case in 2000) the Federal Reserve is changing course which will have a significant impact on risk assets. They’ve created an enormously overvalued bond market where the “real” (real is interest paid minus inflation which is at 7%) is negative. 10-year Treasury yield was recently at 1.87%. 1.87% – 7% inflation = -5.13% real return.

The Fed and other Central Banks are in a “damned if they do and damned if they don’t” situation – a situation they’ve created themselves. They’ve created inflation which is not “transitory” in the short term and is compounded by supply chain issues and low unemployment-high wage growth (a major component of inflation). If they don’t raise rates inflation would likely run rampant which can lead to return of 1970’s style inflation. (I worked in a grocery store in the 70’s in charge of the coffee and cereal aisle. It was common to cross out old prices and add the new higher price more than just once a week)

Risk assets will decline – especially high growth related investments. This could include real estate but to a lesser degree. The increase in home demand and shortage in home construction make this a very tough call.

Raising interest rates are toxic to uber high valued Growth stocks since it increases the risk that future revenues and earnings will be reduced. Plus, using a Discounted Cash Flow model those high multiple earnings are not worth as much when risk free interest rises from 0% to 2.5%.

It’s conceivable that the broad based market indices could drop 20% or more this year. The cabal of Growth (Apple, Google, Microsoft, Netflix, Tesla) which have propped up the market since last February could face serious declines.

The valuation gap between Growth and Value is the highest since 2000. While the S&P 500 Growth index has a Price/Earnings ratio of 27, the P/E of Value is just 17. Last week Growth sustained the worst one-week loss relative to Value in 20 years. Bubbles burst quickly.

#2 The Pivot To Value: After the Growth stock bubble broke in 2000 there was a prolonged pivot to Value stocks that lasted for 7 years. However, Value stocks are still at risk in a sharp market pullback. They generally decline less than growth, so they are still at risk here.

Value stocks by and large are boring especially compared to Growth. But due to their inexpensive valuations they (in a broad perspective) are not nearly vulnerable to interest rates. Plus, according to Credit Suisse “S&P 500 Value is expected to deliver faster EPS growth than the Growth index (26% vs. 16%) in 4Q21 as well as in each quarter in 2022.”

Due to the 14 year dominance of Growth over Value, Value has a small footprint in the mutual funds popular today. Many mutual fund families offer no Value alternatives at all or have closed funds due to their lack of performance. It should be said that Value was not always a lagging investment style. The 1970’s and 80’s were dominated by Value especially during the mid 80’s take over frenzy of undervalued companies.

A key term in Value investing is the “Margin of Safety” concept. Hedge fund manager Seth Klarman wrote about the concept of “margin of safety” as it relates to investing years ago. It means that the current stock price is significantly below the tangible and intangible assets of the company. A stock that is so relatively inexpensive that its downside risk is likely limited. But, has an upside potential that is several multiples greater than the risk.

It’s very balance sheet oriented and frequently populated by companies where growth is subdued. There are no glamour stocks in the Value realm :). The Margin Of Safety (MOS) has nothing to do with short or intermediate term price movements. Its significance is in the long term.

A key investment rule I have is that when significant market sell-offs are finished the time is right to think longer term rather than short term. This means focus on quality at a reasonable price first. The farther we are away in time from a large sell-off the more shorter termed we’re focused on owning.

In November you could have bought Microsoft at $349 with the idea that “I’m a long term investor”. Well, now that its at $296 that seems pretty silly. But now, the sell-off has presented itself which changes our perspective to the long term.

The first selection in the high quality “Margin of Safety” realm is ViacomCBS.

ViacomCBS (VIAC) $32.5 a share with a 2.7% dividend with a viable chance for a sale of the company at over $60 per share.

VIAC is a premier media company with an extremely low valuation where the reward is potentially a multiple of the risk.

Viacom was built by Sumner Redstone who died in 2020 at age 97. His ownership was passed on to his daughter Shari Redstone. Viacom was once a dominant media company but in the last twenty years has been dwarfed by the group of Amazon, Apple, Comcast, Google and Netflix.

In March 2021 Archegos Capital was forced into liquidating their media holdings in ViacomCBS and Discovery. The sale was due to discovery of Archegos extreme and over-leveraged accounts. Shares were sold regardless of price and the shares of ViacomCBS which peaked at $99.99 fell to $36 within a month. The shares remained lethargic since then.

Shari Redstone is 68 years old and controls VIAC by her ownership of 79.5% of the class A shares. It’s likely she recognizes that critical mass (“size matters”) in the streaming business. Essentially, Viacom is a small fish in a very large and growing pond. While Viacom can earn close to $4 a per share share in each of the next 2 years long term growth is limited due to their inability to directly compete with the media Goliath’s. Current EPS estimates for ViacomCBS in 2022 is $3.90 a share.

What is changing the landscape for media companies is the increased present and future costs of Streaming media. A sale of VIAC to a company with abundant financial resources seems to be the odds on course for Ms. Redstone. While various measurements of the company show it might be worth as much as $75 per share using a sum of the parts valuation. A sale in the $60’s might be more likely.

The concept as it applies to VIAC is the valuation of the company at less than 9x earnings. A sum of the parts valuation that puts the potential value of VIAC to at least $60 per share and possibly $75. Much of the value is their legacy programming.

VIAC streaming business is growing faster than most of its competitors. They recorded almost $1 billion in streaming revenue with a 90% growth in subscribers.

Earnings are expected in the $4 to $5 range per years for the next three years which implies an extremely attractive valuation on earnings per share alone.

Insider buying? You bet. Shari Redstone and President/CEO Robert Bakish made large purchases in November and December at the $36 price range. Bakish has also publicly expressed his dismay at the current price per share.

While the odds are growing for a potential sale of the company the timing is impossible to anticipate. It’s possible that one morning we wake up to find a deal is complete. Therefore my intent is to hold the shares for a potential lengthy period of time.

If a sale does not occur, the forthcoming earnings in the next 3 years alone should generate a decent increase in share value.

“Deutsche Bank analyst Bryan Kraft upgraded ViacomCBS to Buy from Hold with a price target of $43 up from $39. The analyst believes Viacom offers “optionality” (meaning multiple ways to increase the share price). This includes valuation multiple rerating, greater success in streaming, and potential industry consolidation (a sale of the company) as Mega Cap Tech “sets its sights on becoming bigger streaming players”. Viacom’s enterprise value is a “fraction of that of the other four scaled content companies”. Yet, its annual content budget places it within range of the Mega Cap peer group. Kraft tells investors its his top pick in media.

From Dan Niles, Founder and portfolio manager of the Satori Fund, a tech focused hedge fund:

“I am an investor that likes stocks with growth at a reasonable price. VIAC trades at 8x CY22 PE despite their streaming revenues up 62% y/y. This is incredibly cheap compared to streaming leaders NFLX (46x PE; revs up 16% y/y in CQ3), DIS (~34x PE; streaming revs up 38% y/y in CQ3), and ROKU (~121x PE; revs up 51% y/y in CQ3.) These streaming leaders are all growing their streaming revenues slower than VIAC yet fetch much higher multiples. In addition to VIAC’s asymmetric growth vs. valuation profile, VIAC’s $1.1B in streaming revs in their September quarter grew to 16% of overall company revenues. NFLX is trading at 10x trailing sales. VIAC should do close to $5B in streaming revs this year, so it does not seem unreasonable to assume $50B is a reasonable valuation for this business alone. However, all of VIAC has a market cap of only $21B with ~$10B of net debt assuming current announced deals close.

From a subscriber perspective, NFLX had 214M subscribers at the end of Q3:2021 with a market cap of $267B. A valuation of ~$1,250 per subscriber. VIAC now has 47M streaming subscribers with 54M ad supported streaming subscribers from Pluto TV with a market cap of $21B. Just the value of the pure streaming subscribers for VIAC is $59B on this metric.

While we have admitted our mistake and cut our position in VIAC to take a tax loss for 2021, upcoming Q4 results and the outlook for streaming losses hopefully sets a bottom for the stock and sets the name up for a good rest of 2022. Investors may want to go to the sidelines until guidance is given on Q4 results or sentiment reverses for the company.”

Summary: We will continue to hold very high levels of cash until stability returns to the markets. The rate of decline in superlative stocks such as Apple and especially Microsoft make them attractive for long term holdings.

My focus is to use this selloff to focus on Quality above all else.

ViacomCBS is a wild card. Despite the potential for short term volatility (such as todays fallout from Netflix) the long term is very promising with the potential for a sale this year. ViacomCBS is a special situation and it will remain the only “special” holding we own.

Eventually this selloff will end. Preservation of capital and patience should be prioritized for the time being.

Thank You for reading,

Brad Pappas