Bring On The Sell-off!

1/30/2021

Quick Summary: Two weeks ago I began raising cash in accounts because investor sentiment was too hot and market breadth was eroding. Too many traders playing with borrowed money “margin”. It appears we’re seeing forced liquidations as we’re down another 600 pts. We don’t need a formal Sell signal to occur when our Stop-Loss orders get triggered en masse. The combination of too much speculative trading in margin combined with future market scrutiny by regulators may be causing institutional investors exit by the side door.

We presently have just two stellar holdings: Sivergate Financial and Innovative Industrial Properties. In both cases we have such a large profit cushion and they continue to show relative strength in weak market that taking a profit here may not be the wisest of choices.

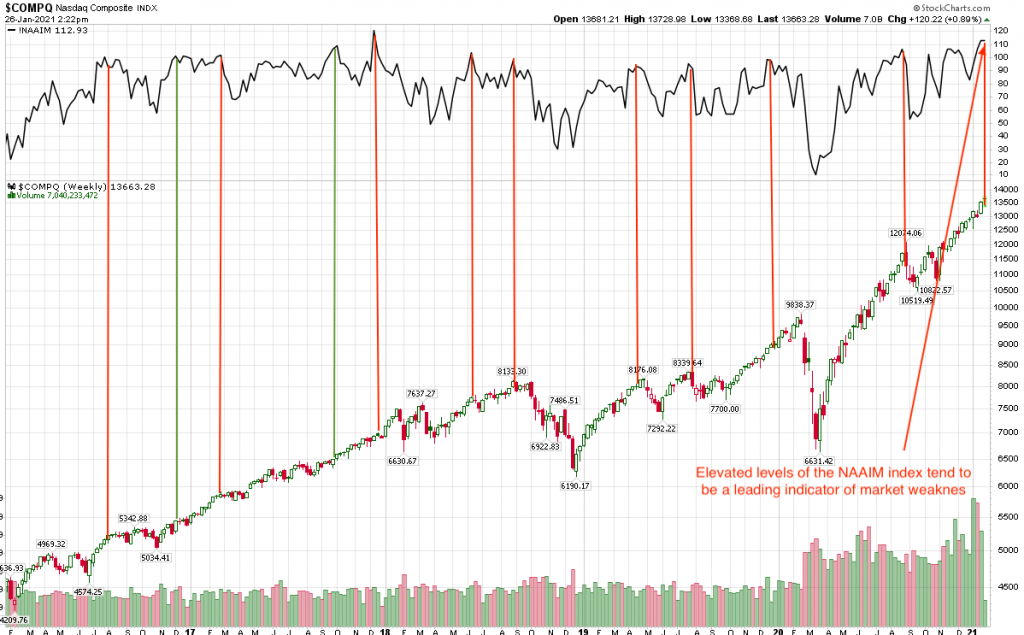

The NAAIM Index (naaim.org) publishes a survey of active managers like RMHI to find out their current market exposure. Last week’s reading of 112.93 is rarely seen and means that not only are active managers over 100% invested but they’re adding leverage/margin. As the chart shows these kinds of readings are common near intermediate term market peaks.

For more than a month I’ve been watching the grotesque level of mindless speculation that has exploded with Gamestop or GME. The media has created an image of the small time investor having revenge upon the evil billionaire hedge fund managers, akin to David vs. Goliath. Nothing could be farther from the truth.

The business of Gamestop has not changed. They have an eroding business model where gamers no longer need to go to a store to buy games since they can download them from home or where ever.

Short selling is not new and serves a valuable service since short sellers seek out and punish fraudulent companies.see Enron, Worldcom, Conseco, Baldwin United, etc. This provides a checks and balances alternative to the always bullish media market hype.. In addition, most stock market rallies begin when short sellers start to buy stock back to lock in profits which creates the initial market bounce.

What is new is the interest rate policy of the Federal Reserve manipulating interest rates to near 0%. Near zero interest rates crushes savers who used to rely on CD’s and other interest bearing instruments. These investors are then forced into risk assets such as stocks.

Near 0% rates coupled with substantial stimulus money, bored people, time and smart phones on hand have created a toxic mix of speculation. Trading in GME is a textbook Greater Fool Theory. The fool who pays $337 for GME shares needs an even bigger nitwit to sell to at a profit.

Short sellers who were short the shares of GME are then forced to buy GME shares to cut their losses. Thus creating a whirlwind of self fulfilling behavior.

I’m fairly sure that at the root of this is not the little guy small investor but other big players, They’ve created a modern day Ponzi Scheme. Big players who made early bets on GME back in September when it was trading under $10 are the real beneficiaries.

The tactic of using Social Media to channel investor behavior is new and probably here to stay. Just this morning Elon Musk tweeted that he like Bitcoin which sent our shares of Silvergate to a new high of $102.

It’s laughable to me that the politicians and regulators who were asleep now want “investigate” and show concern for the very environment they created.

But all of this kind of behavior is really nothing new. As Jesse Livermore said over 100 years ago: There is never anything new in the stock market. Human behavior never changes. It always shifts from fear to greed and back to fear again.

However, the levels of speculation we’re witnessing are associated with market peaks. Less reputable brokers like Robinhood run a real risk of becoming insolvent due to the probability of unsecured debits in client accounts. In other words traders who are borrowing money to buy GME can not just lose the equity in their accounts but have the value go into the negative.

Or, as I witnessed last night Robinhood forced traders out of their holdings without their knowledge or consent at the the low price of the day? Guaranteeing losses? Bring on the lawyers and class action suits.

In my experience this period of market history is fascinating and eventually probably will lead to tremendous losses. Investors of all kinds tend to act in a herd mentality and when the herd decides to start selling, my guess is the market could easily decline by 20% or more.

If we’re lucky.

I hope we do decline. We are prepared for it with an extremely high amount of cash on hand. Smaller accounts are 100% cash.

I would love nothing more that be presented with a new Bull Market cycle that would reveal itself after a severe market decline.

Risk Control

I’d like to spend some time on how RMHI emphasizes risk control and the methods used. Clients never see this data. If you access your account at Schwab or from your account statements you won’t be able to find it. I spend most of my days monitoring a dashboard of potential open trades that are stop loss orders.

A Stop Loss order is an order that I have placed at Schwab on your behalf to protect your principal. At the time of purchase I’ll add a Stop Loss Order set between 4% to 5% below cost. This is all I’m willing to lose and it means that losses will be small. But it also means that trading is going to be more frequent. There’s no perfect formula but I find that 4% is very effective despite more activity.

When we buy a stock and it declines from the initial prices to a loss between 4% or 5% the shares will automatically be sold. It’s not a guarantee that the sale price will be exactly at 4% since the next trade price could be lower.

Should the stock price rise the Stop Loss order rises accordingly. If the shares rise 7% or more the Stop Loss Order is adjusted to the cost of the shares. A winning trade should never be allowed to be a loser.

One way I wanted to improve performance was to find ways to increase our Profit to Loss ratio. A 2-1 ratio means we’re averaging a gain of $2 for every $1 we lose. A P/L ratio of 2-1 is good but ours had fallen from that level to 1.6 to 1 which is unacceptable.

To improve the P/L ratio it means a complete reevaluation of how stocks are selected and an effective formula for how they are sold. Its been my observation that the good trades work almost immediately, usually within a day or two since the purchase. Once the trade proves itself I’ll add on more shares which is called “pyramiding”.

But in a favorable market a 4% stop loss is very effective and if the order is “stopped out” meaning it was executed, we just move on to another stock with favorable behavior.

Cutting losses short also means we don’t dwell on them for weeks which could cause us to miss out on other potential winners.

The key is to identify which stocks could be the significant winners and to let them run for as long as they can. Stocks like Silvergate are rare and in most cases its best to sell a stock if it reaches a gain in the 20% range.

But even if a stock only rises by 10% when the gain is taken its still a 2-1 win loss ratio if a 5% stop loss is used.

Last week I decided to calculate what our Profit/Loss ratio has been since I made the changes. I used the model account I have to collective2.com. Its the fairest way to measure since it copies our own trading in an objective way.

Since November and up to this week our Profit and Loss ratio had improved to 5-1, which made me very happy.

However, the P/L ratio of 5-1 does NOT include our existing holdings, only those shares that were sold. Since the sale of 1/3 of our Silvergate shares this week our cost basis rose from approximately $28 to $35. Meaning the gain from $35 to the present price of $94 has not been taken into account. The same holds true for Innovative Properties.

The bottom line for the use of Stop Loss orders and in coordination with proprietary market buy and sell signals is to smooth out the growth of equity in client accounts.

We will not always be invested but fully invested only when the odds are in our favor.

Be Well. Be Kind.

Brad Pappas

January 21, 2021

Long all stocks mentioned.