When is a good time to sell?

(Answer: not now)

March 2017

Summary: US equity markets remain in a strong uptrend which shows no signs of abating. Markets that have broken out from multi-years of trendless behavior can last for quite a while and deliver significant returns. So at this point we need to sit tight and let the rally continue and grow our equity. I will continue to allow our good performing stocks run as far as they’re trends remain intact. Almost all the activity in your accounts is related to the laggards and losers as I have minimal patience when better options present themselves. Our focus remains on the two best performing industries: Semiconductors and Finance.

In addition, I’m seeing a change in character in two industries thought to be in the dumpster: Solar and phones companies (Specifically, Canadian Solar -CSIQ, America Movil -AMX and Nokia -NOK). If any of these stocks are genuinely in a new upward long term trend they would likely be home run stocks, but time will tell.

Treasury bonds and interest rate related securities continue to act poorly and are to be avoided. This poor action is a positive sign for stocks as they’re a sign of a healthy economy.

_________________________

Markets and economies are cyclical and you can add recessions/bear markets to the death and taxes mantra of sure things we’ll experience. In these letters in the past I’ve generally focused on the economy or interest rates as a tool to identify high risk environments. So, in this letter I want to spend a little time on what I call our “Primary Trend Filter”.

The primary purpose of having a Primary Trend Filter is to eliminate emotions and avoid the big loss from the investment process. It’s too easy to fall prey to emotions in a rising or falling market where you lose objectivity to the prevailing trend. In addition if you’re over 50 years old time becomes an issue as you have fewer years to recoup the loss.

Just about every study I read regarding losses assumes the investor is “buy and hold” with the silent assumption that it’s impossible to “time” the market. Not only is this wrong but it’s highly biased based on the compensation plans of the mutual fund industry. Funds are paid top dollar when you’re invested in equity mutual funds and receive minimal compensation when you’re in cash or Treasury funds.

Investors are bombarded with subjective media. Today, 3.13.2017 I received an email from the investor service Zacks titled “The S&P will double in 5 years.” To quote; “Sounds like a Herculean task on the surface, but it’s really not. In fact, the market only needs to gain on average of 14.9% per year in order to do so. That’s not such a stretch given the market has been averaging 14.9% per year since the bull market began in early 2009”……..

“My 5 year doubling thesis also means that we won’t see another recession until stocks double again,nor will we see another bear market until stocks double again. Got it?”

At no point his article does he even mention interest rates, the effect of past Quantitative Easing on the “14.9%” returns or the Federal Reserve. Why interrupt a good story with the thought of higher interest rates.

Predictions like the market will double in five years have no basis in a serious investment conversation and are meant to sell memberships and generate publicity. And, there is no accountability if the author is wrong.

On the flip side of the markets is this generations Dr. Doom, Mark Faber. He sells his version of fear with almost an annual prediction of a crash. He’s right about once a decade and he never changes his tune but how objective can he be with https://www.gloomboomdoom.com/ as his domain?

Will either be right, who knows? But these kinds of calls are common and best ignored. Prediction odds are always a coin toss although some are 50-50 and some are 1 in 10. But they’re all guesses and nothing more.

Rather than basing a strategy on someone’s subjective opinion, I’ve found that objective mathematical systems are far more accurate and profitable. They make far fewer mistakes and can prevent an investor prematurely buying or selling. Many pundits can only wish their calls were as accurate. These

systems will never get you out at the absolute top or bottom but they will have you correctly positioned for the bulk of a new trend.

These types of systems are especially valuable to those of us who can’t afford a 30% decline (as if anyone can) but still need the returns generated by stocks. Unfortunately for most investors these tools are generally not utilized by most financial planners, brokers and absolutely not used by the mutual fund

and robo-advisory industry. These outfits rely on “buy and hold” with the inevitable risk of big downdrafts.

But they are in various forms utilized by some of the best independent advisory firms, independent and institutional proprietary traders.

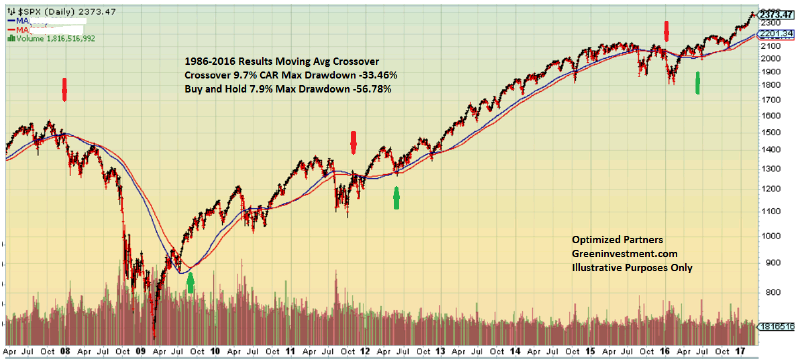

The following two graphs are my primary exposure filters for stocks. I also use several monetary and leading economic data for confirmation. When they give a green buy signal we know the odds are heavily in our favor. I only want to have stock exposure for my clients when the odds are in their favor

otherwise cash or Treasury bonds are a better alternative.

Primary Trend Filter #1

This is a system I created with Cesar Alvarez of Alvarez Quant Trading. It’s a simple (simple is good) moving average crossover system that in testing since 1986 delivered a higher annualized rate of return than buy and hold. Using this system the CAR (compounded annualized return) was 9.7% versus 7.9%

for buy and hold since 1986. Best of all, it lowered the maximum downside risk significantly.

The worst calendar year for this system was 2008 when followed strictly generated a loss of -9.39% but compared to buy and hold the loss was -38.49%.

In reality I don’t often wait for a system like this to trigger if the downside momentum is too great as was the case in late 2015 and 2016. The rapidly falling momentum in those instances told me that a break of the 200 day moving average was inevitable and the poor economic data backed up the sell

signal. So I didn’t wait for the formal signal to keep any losses to a minimum.

I’m not interested in market timing systems that increase return, what I’m primarily interested in is reducing downside risk. The by-product of reduced downside risk is a higher rate of return. Profits will take care of themselves but big losses are to be avoided.

Primary Trend Filter #2

The MACD indicator shown was developed by Gerald Appel of the old Systems and Forecasts in the late 1970’s. In most cases this indicator is used for short term time periods but I think it’s of special value when looked at on a monthly basis. It’s a very slow moving indicator whereby the buy and sell periods

tend to last for at least a year. It also caught the tumultuous 2015-2016 period and flipped to a Buy last summer.

One might ask when looking at the Sell signals whether it’s a good time to short stocks in anticipation for a prolonged bear market. I’d say yes but for only a small percentage of capital since bear market volatility can be huge. Better yet, the sell signals happen to be great signals for buying long term

Treasury bonds. The price appreciation of long term Treasuries tend to move into their own bull market as a “flight to safety” from stocks to bonds emerges.

Lastly, as you can see in both charts now is not the time to sell. Market tops take time to develop frequently a year or more in the making. Considering that we just broke out from a 2 year sideways trend our current rally could last quite a while. Eventually it will end and that will likely coincide with

peaks in employment and an aggressive Federal Reserve and the behavior of the stock market will be reflected in the charts above.

In the meantime market pullbacks will likely be shallow in the 5% to 8% range before prices launch the next leg higher.

Cheers,

Brad Pappas