I should get around to doing this more often as we are in the minority when it comes to investment advisors willing to post portfolios and returns. I’ve advocated for years that retail investors don’t have to settle for the returns offered by indexers and robo-advisory firms. Robo’s are cheap but you won’t receive what we offer in terms of returns and bear market protection.

The Vegan Growth Portfolio is a name we use to describe the concept of investing with Vegan perspective. Its a diversified portfolio that usually has about 30 holdings when fully invested. When our indicators tell us that when stock market risk in unacceptable due to the potential for recession we reduce our stock holding and focus on Treasury bonds or cash.

Collective2.com offers a unique opportunity to create a mirror portfolio of our client holdings in the Vegan Growth Portfolio. In other words, the same day we buy or sell a stock for our clients we also buy or sell it in the VGP. The price may differ by a small amount but the Vegan Growth Portfolio shown on Collective2.com is close approximation to our client accounts.

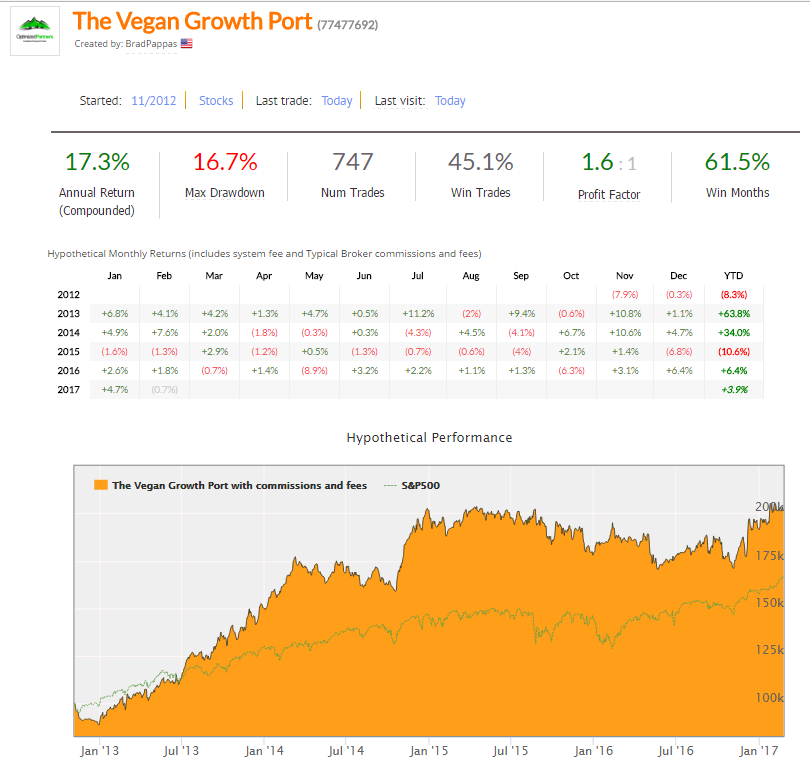

As you can see we are soon arriving to the important 5-year return milestone. As of 2/24/2017 the compounded annualized rate of return is 17.3% which is net of all fees and expenses. The gross (before fees) return is 18.8% per annum.

We respectfully ask when a potential client’s first question revolves around fee’s is which would you prefer: Make 4%-6% net at a indexer or robo-advisor like Betterment or our returns which charge more?

This example assumes and account size of at least $100,000. And, as we always have to say past performance is no guarantee of future performance. VGP is only suitable for investors who appropriately seek growth.