Like so many other investment firms we had to endure the market decline in 2008 but being an independent firm we have the freedom to also say “never again”. We’ve reached a point in our lives and stomach lining that there had to be precedents before the recession that could provide a heads up if a recession is looming. In fact, over the years we’ve found many including Inverted Yield Curves written none other than the Federal Reserve.

One thing you’ll notice over time with our blogs or letters is that we’re not opposed to using the research of other firms especially if they blend nicely with our own systems. We have often relied on academic research of others to build upon and couldn’t care less if research results were developed by others. We always find it a bit small minded that so many firms insist on relying solely on their own research or incredulous when studies that could really help their clients are ignored. Why reinvest the wheel if its already been done by someone else?

Our priority is to develop effective systems which deliver superior results to our clients and not claim that we have a monopoly on great ideas. We have just a few criteria’s that must be met for inclusion to our own systems. System should be open (no black boxes) and understandable and best of all, relatively simple. Too many times we look at systems of others that have done a remarkable job in back testing but when you look at the system details there’s a large number of criteria which just makes us think the system has been optimized to inevitable failure.

Things brings me back to Bob Dieli of www.nospinforecast.com

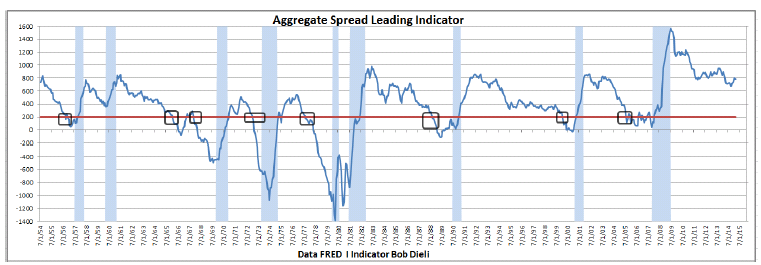

Decades ago Bob developed the Aggregate Spread as a leading indicator of US recessions. The formula is absurdly simple for those inclined: Take the 30-year Treasury bond yield and subtract the yield from the Fed Funds rate. And then take the CPI rate and subtract that from the unemployment rate. Then just subtract the yield spread from the result of the CPI minus the unemployment rate. That will give you the Aggregate Spread.

When the Agg Spread dips below 200 the odds become very high that a recession is expected in the next 9 months. Simply put to you the investor: If you have high probability of advance knowledge of an incoming recession why would you want to own stocks or own stocks un-hedged?

One of the great things about Bob’s Agg Spread methodology is that it goes back a long ways, back to the days of Elvis, 1954. Bob has been operating the system since the early 1980’s. During this time the system algorithm has never been changed either.

While the Agg Spread is not a guarantee of a recession or the ensuing Bear Market in stocks that could cause investors to lose 20% to 40+%. Using the Agg Spread places the investor into a position of preemptive rather than reactive. With this type of knowledge investors can have an advanced warning to move at least a portion of their assets out of stocks and into short term Treasuries or hedge the portion of the portfolio close to 1 to 1 that closely correlates to the S&P 500 with the symbol “SH“.

Brad Pappas

No Positions