March 11, 2023

Late last year I noted a sharp difference between the bank deposit yields that Schwab was providing of approximately 0.4% versus short term T-bills of 4% or more. Seeing this interest rate spread I moved the majority of client cash to T- bills at +4% or more rather than let it sit in a Schwab earning almost nothing.

As I’ve mentioned this was a simple choice to make which allowed us to earn interest while the Bear market in stocks and bonds evolved.

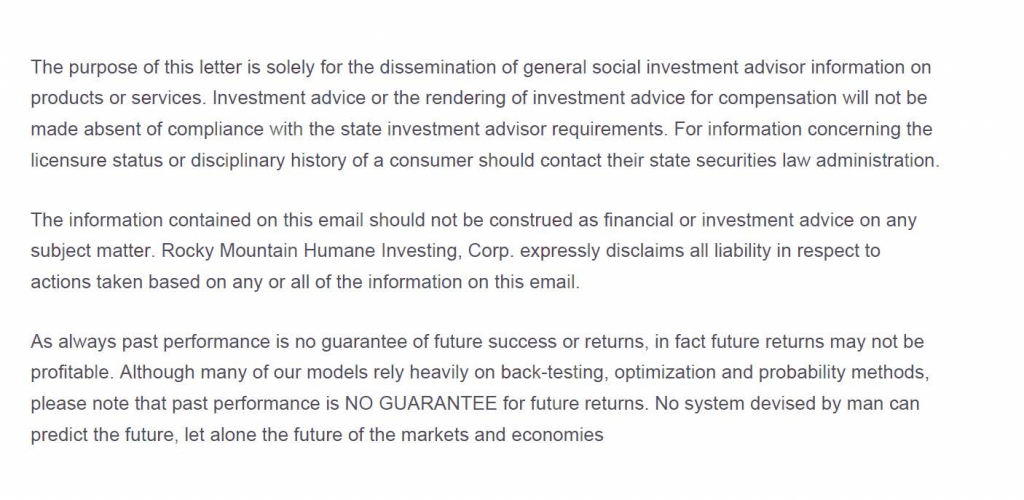

Banks and brokers have been negligent in raising money market interest rates to be competitive to short term T-bills because they earn quite a bit of revenue off the spread. They’re able to earn risk free rates in 3-month T-bills at 4% or more while the source of capital (your cash in money markets) earns under 0.5%.

Previously, outflows from bank interest rates were slow and since there was no urgency banks were slow to raise depositor interest rates.

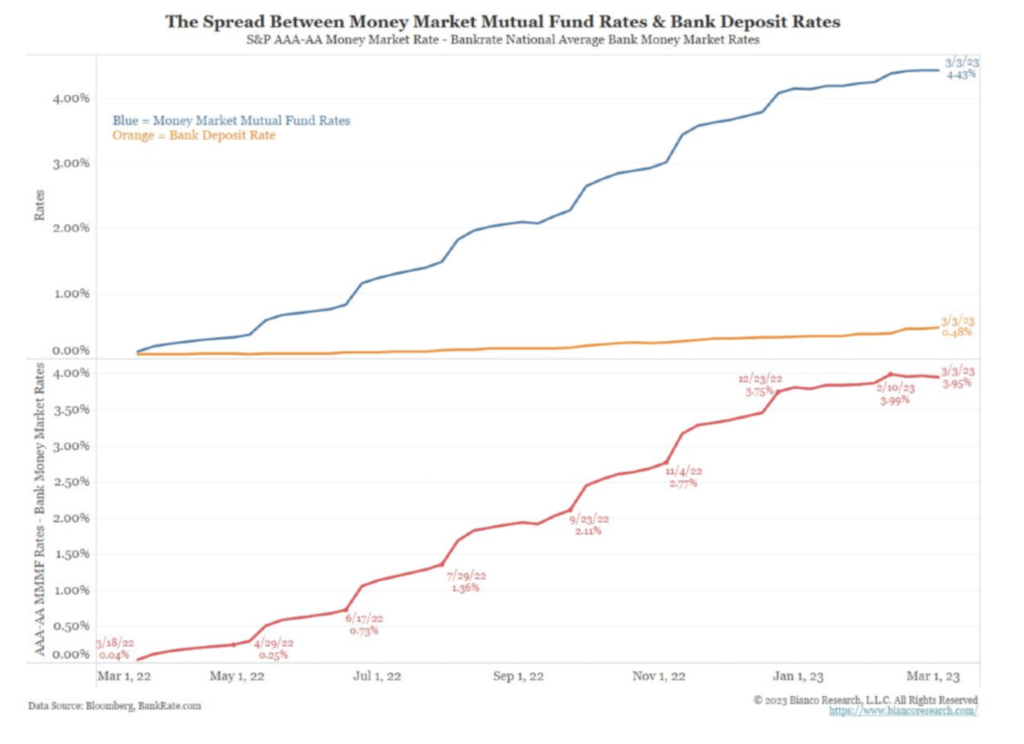

This lack of urgency changed when the Fed’s interest rate hikes grew meaningfully and investors recognized the interest rate difference.

The chart below shows how higher paying money market.

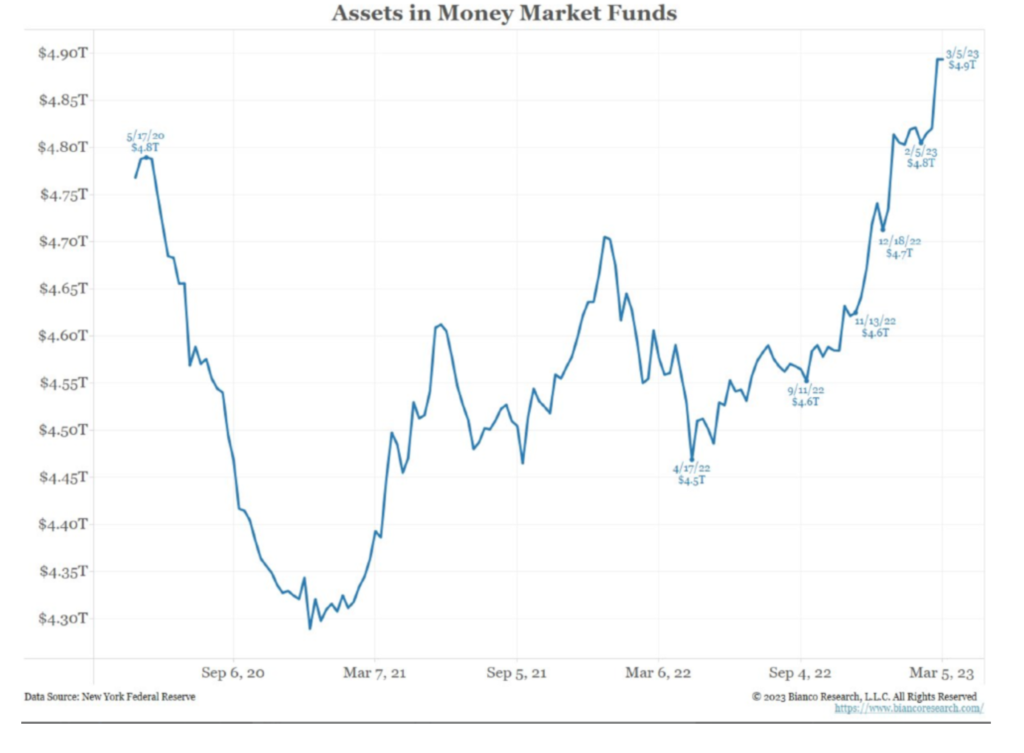

As bank deposits decreased dramatically and moved into money markets in the past six months it forced banks to increase their liquidity by selling off other assets to raise capital to meet demand.

This is where the rubber meets the road. Exactly how was the bank investing the client deposits?

This is where SVB got into trouble. There is nothing like a 40-year trend in lower bond yields = higher bond price values to make bankers complacent. SVB invested a very large percentage of depositor assets into long term bonds. In other words the bank too substantial losses due to complacency and a lack of risk control. SVB did not hedge their Treasury bond risk.

If I were to use the $TLT ETF which holds Treasury bonds in the 20-30 year maturity range as a proxy: The TLT price peaked at $151 in December 2021. Yesterday it traded at $105.

SVB chose not to take the loss by selling and moved the bonds to a “Hold to Maturity” or HTM classification. If they took the loss it would have been reflected in their quarterly earnings reports.

Moving the bonds to HTM reduced the liquidity of the bank to meet day to day business. So, to replace the cash that was moved to the HTM category the bank offered to sell bonds, stocks and preferred to the investment community. Obviously, the offering was rejected and a run on the bank began.

Shares of SCHW were down 11% yesterday and I’m taking particular notice. At this time it does not appear they face the same risk as SVB. So far, SVB looks like an isolated event of risk of poor judgement and lack of risk management.

The decline in share price could come down to two distinct reasons: The long awaited merger with TD Waterhouse could be called off.

Second, the interest rate spread I mentioned earlier is a large source of revenue for Schwab. This is the age of no-commission trading so Schwab had to offset the loss of commission revenues in other ways. Paying next to nothing for deposits was large source of revenue.

Volatility

At present we have roughly 3% exposure to stocks. The balance is a combination of cash, Treasury bills and Municipal bonds. We have very little exposure to risk which allows us to be patient and let this storm blow itself out.

Many times I’ve said that when the Fed starts raising rates “things break”. SVB is case of a “Break” but I expect more to come. The breaks don’t have to come from banks, they can come from anywhere and they can be sudden.

Famous “breaks” are Enron, Worldcom and Madoff. All three emerged during Bear Markets.

For the past year and a half I’ve been very negative for stocks and was unable to embrace the rallies with any enthusiasm. Now, my tune is changing.

I will continue to be patient as there is no need to act right now. But my sense is that at some point (and there could be many points) in 2023 stocks will bottom and offer a great opportunity for those who’ve protected their assets this year.

My focus will be on the highest quality holdings. Major market bear markets are the best time to buy the highest quality stocks. Depressed prices offer a great opportunity to buy into franchises that rarely meaningfully sell off. These are the companies you can hold on to for the long term.

These companies are dominant in their category and frequently have a wide moat (dominant and difficult to compete against).

Examples are:

Monster Beverage

OTC Markets

Accenture

Adobe Systems

Autozone

Cintas

Google

Home Depot

Moody’s

Old Dominion Freight

Mastercard and Visa

Microsoft

We can afford to be patient and sit on our hands waiting for the right time to move. I suspect it will be this year. The time to be negative in the long term is over. Now is time to look for opportunity.

When the stock market rallies, the expected forward return for stocks declines.

When the stock market declines, the expected forward return for stocks rises.

Thank you for reading and being a client.

Brad Pappas