May 5, 2019

“The Federal Reserve…is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up”.Fed Chair William McChesney Martin 1955.

“I think we are actually at the point of encouraging risk-taking and that should give us pause. Investors really do understand now that we will be there to prevent serious losses.” Fed Chair Powell in 2012.

“If the Dow Joans ever falls more than 1000 “points” in a Single Day, the sitting president should be “loaded” into a very big cannon and Shot into the sun at TREMENDOUS SPEED! No excuses!” DJT tweet, February 25, 2015, 12:27am

Any wonder why we seem to have more risk asset bubbles these days?

Quick Summary

Stocks: Stocks have have made a stunning rebound from a near-death experience last year and continue to trend higher. On any market weakness, the White House continues to trumpet a near and close China trade deal. In addition, the economy has turned modestly up again which provides a positive back drop for stocks. My guess is there is a selloff looming as the current rally is losing steam. But the Fed will likely step in and lower rates if a selloff occurs, so the decline would be worth buying.

Fed Policy: The Fed has done a complete 180 turn which provided positive stimulus to both markets and the economy. Much of this has been done at the expense of Fed credibility.

Considering the public pressure being imposed by the President both in public statements and Fed board nominees, we do have to wonder how unbiased they really are.

DJT’s preference to stuff the board with sycophants is troubling but there has been stiff resistance to Cain and Moore. Kudlow’s claim that they’ll never hike rates again in his lifetime is just as bad. Investors may feel invincible with the mistaken belief that the Fed will bail them out from future declines.

The bottom line IMO is the Fed being willing to risk their creation of another asset bubble in the hopes of extending the economic expansion is irresponsible. Our expanding deficits will never be paid off either. Eventually this view will be inflationary wherein the dollar has little meaning and makes a case for Gold longer term.

Economy: After last years series of ugly macro data, a Spring rebound led by employment and housing is underway. A recession starting in 2019 doesn’t appear likely. This is similar to what we experienced in 2015 and 2016.

Treasury Bonds: Since we’re not facing a recession in the near to medium term, the rationale for owning Treasury bonds diminishes. Bonds will likely be a drag on returns and holding uninvested cash in money markets is likely a better alternative.

The bearish argument for bonds is MMT otherwise known as Modern Monetary Theory. Simply stated, MMT is the federal government printing of new money to fund governmental expenditures. One of the risks is a significant increase in inflation. More to come.

Despite the market strength from the late December lows it has been a frustrating period for an investor who uses the past as a guide to the future. While we did manage to keep losses minor in the September to December selloff, we have not nearly kept up with the resulting rally.

The Fed and other Central banks stepped in to halt the decline by easing their monetary stance. Markets should be allowed to trade without continual interference from the Fed since occasional purges are necessary to avoid – otherwise the Fed will create a much larger asset bubble.

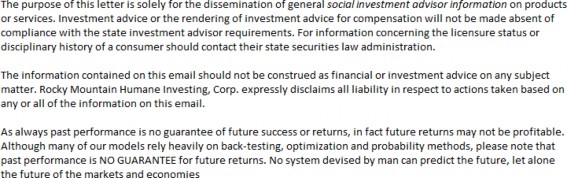

There’s no way to ever be sure where the market will bottom, especially when selling gets as emotional as it was last year. As I’ve mentioned several times, V-shaped market rebounds are generally a low probability since 3/4 of all market selloff’s retest the recent low in a matter of days or weeks. For example, from the chart below, the January 2018 selloff retested the lows 3 times. The precipitous decline late last year did not retest even once, which left us too cautious when we should have been much more aggressive.

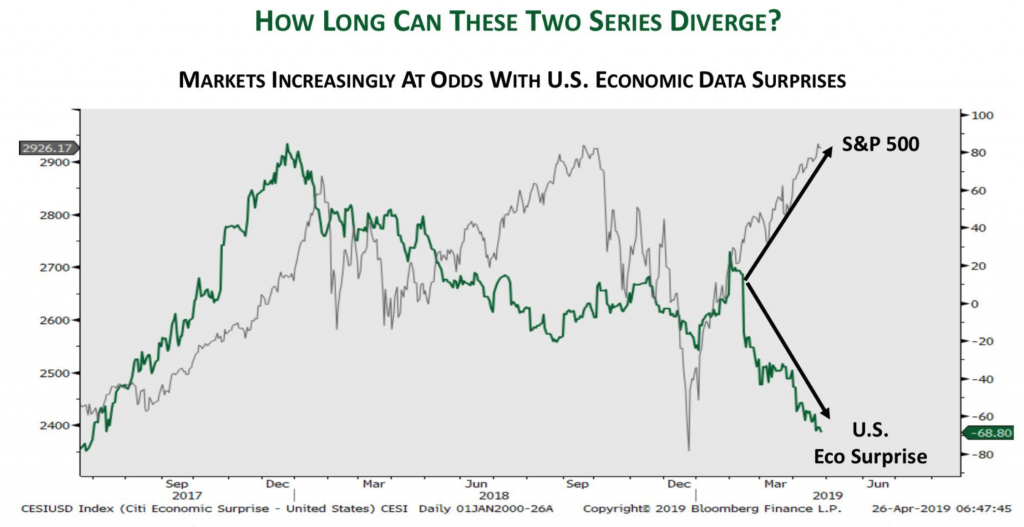

In addition, despite the new highs in the indices, there is erosion below the surface. The number of stocks participating in this rally in the Nasdaq is declining. When I see this kind of erosion in participating stocks, I prefer to hold higher than average amounts of cash in lieu of trying to force the issue. Early warning industries like semiconductors, such as previously held Xilinx and Nvidia, have issued warnings of declining sales which means the underlying global economy is not good. Even Amazon, which reported great earnings and continues to grab market share, is seeing the slowdown as well.

Fewer stocks are holding above their moving averages, revealing a weakening rally and likely selloff.

In addition, the number of stocks making new highs is shrinking fast. These are signs of an old tired market that needs a pullback. In my experience, this is a time to have high cash levels rather than increasing stock exposure.

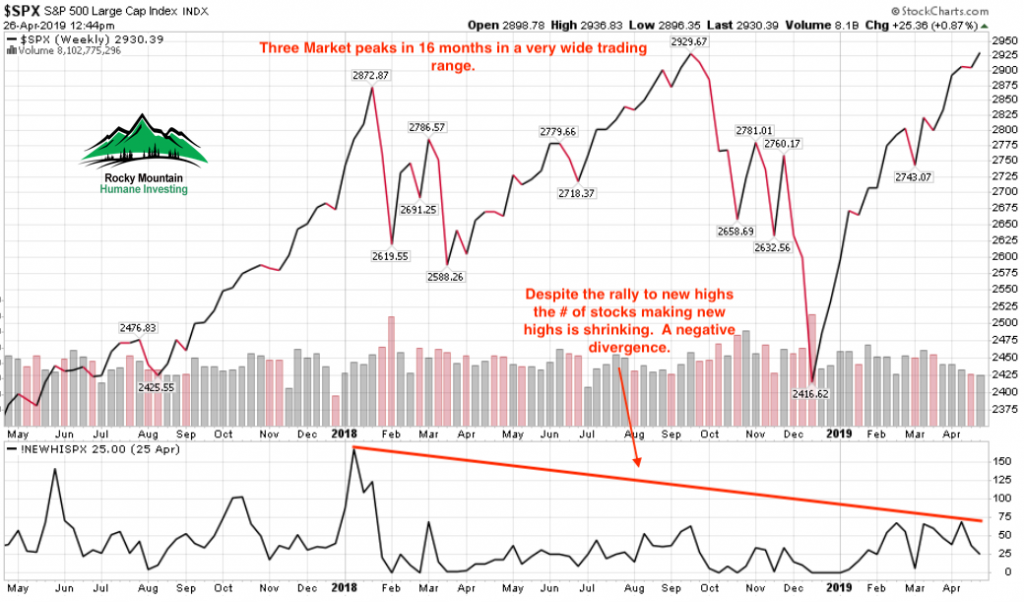

And then there’s this…..

Stocks tend to move in sync with economic surprises. The current gap is due to the significant rally in stocks while the economy has been slowing. Something has to give eventually. Either data turns up or stocks come down or meet in the middle.

The first four months of the year have been the most challenging for myself in years. I read today that this year’s rally is the strongest since 1987. And, the commentators say that without irony or dare mention what happened in the second half of 1987. If you’re unaware, it fell 22.61% in a single day (October 19, 1987).

The presidential administration isn’t even trying to hide the fact they’re manipulating markets to their political advantage. If it isn’t the “trade negotiation are going really well” ad nauseam before markets open or middle of the day on a down market day. Or, Mike Pence: “The economy is roaring. This is exactly the time not only to not raise interest rates, but we ought to consider cutting them.” This is blatant and so wrong-headed it staggers me. This should be the time for the Fed to slowly raise rates so they’ll have firepower to fight the next recession.

Does this mean the time to raise rates is in a recession?

But this is all about the next election, to keep a very old economic expansion alive thru 2020 to get re-elected. In their eyes, market selloffs are merely “glitches” which they take no responsibility for because, in their eyes, markets are meant to only go higher, never lower.

Investors not paying attention will eventually get badly burned. Mean Reversion is one most reliable investing concepts there is. From tulips and bitcoin, to stocks and real estate, all bubbles eventually end. The end is always fast especially for those unaware.

Despite my expressed negativity I’m not calling for a bear market at present. Investor sentiment is extremely positive (which is not good) and similar to what we saw last January before markets sold off quick and deep. But any serious weakness will likely be met by Central Bank easing or cuts by our own Fed. So I think any dip is buyable.

As for where we are currently: We are now entering the most difficult 6 month period for stocks and rather than try to make up our lagging year-to-date performance by increasing risk, I prefer to wait for a decline. Eventually even in this endless market advance a “glitch” has to be looming somewhere.

All the best,

Brad Pappas